Addressing Carbon Leakage: A toolkit

As more countries implement carbon pricing and other ambitious climate strategies, concerns are growing over carbon leakage—where production and emissions move to nations with lower climate ambition. This toolkit outlines the available policy options to address this challenge and examines the trade-offs of each approach. Download PDF.

Context

As more countries adopt carbon pricing or other ambitious mitigation strategies, concerns are rising about carbon leakage: the displacement of production and emissions to countries with lower climate ambition. Carbon leakage is more than a technical issue; it raises fundamental questions about how we manage the differences in speed and approach to mitigation across countries. These differences are inevitable and necessary; every country's approach reflects its economic, social, and political contexts, and the Paris Agreement safeguards this diversity. At the same time, the global economy is so interconnected that the cross-border impacts of different mitigation approaches cannot be ignored.

For this reason, an increasing number of countries have established policies to limit this leakage risk. While the European Union’s Carbon Border Adjustment Mechanism, introduced in 2023, is attracting considerable attention, other options exist. Our intention here is to present the toolkit available to policy-makers to address carbon leakage and discuss the trade-offs of each approach.

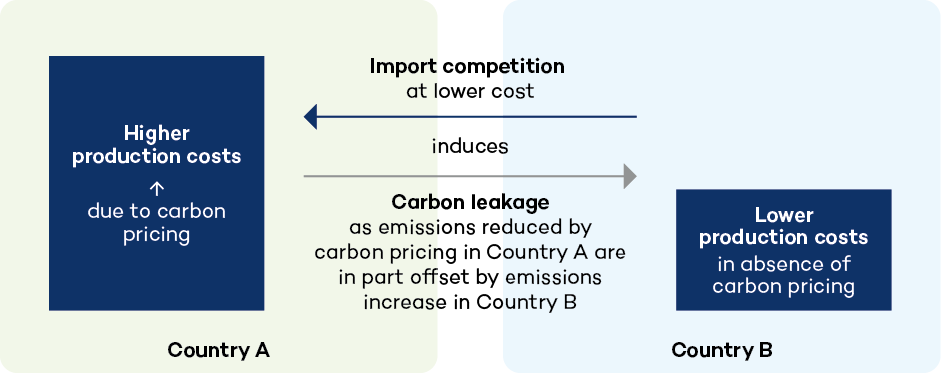

Figure 1. International differences in carbon pricing can generate carbon leakage

Since the early 2000s, carbon pricing has increased in coverage but also diverged in price across countries. The share of all emissions covered by an explicit carbon pricing scheme—i.e., carbon taxes and emissions trading schemes (ETSs)—reached 24% in 2024, up from only 0.7% in 2003, as shown in Figure 2.

In parallel, carbon prices have diverged: in particular, prices under the EU and UK ETSs are notably higher than the ones under other major mechanisms (Figure 3).

That divergence gives rise to concerns about carbon leakage. Indeed, there is growing evidence of it being a fact rather than a theoretical construct. While initial observational studies found little to no such evidence, this could have been due to their focus on the EU ETS during Phases I and II, characterized by low carbon prices and generous free allocations. More recent research by the International Monetary Fund and Organisation for Economic Co-Operation finds average observed carbon leakage rates of 25% and 13%. In other words, a reduction in emissions of 100 tons of CO2 in one country would result in 25 or 13 tons additional emissions, respectively, in another.

These studies obtain these results by observing how increases in carbon and energy prices in one country affect imports toward this country and, consequently, emissions in other countries. It is worth noting that this research is based on actual historical data, not on theoretical models. Leakage may increase in the future, as mitigation ambition is likely to keep increasing at different speeds across countries.

Carbon leakage poses environmental and political problems. From an environmental perspective, mitigation somewhere is partially offset by increases in emissions elsewhere. On a more political level, support for decarbonization is likely to be endangered if it results in a loss of competitiveness.

International Carbon Pricing Frameworks

The first-best solution to the risk of carbon leakage would be a global carbon price; without the price divergences, there would be no advantage for firms in low-price jurisdictions. The International Monetary Fund and the World Trade Organization (WTO) have produced research on hypothetical international agreements where all countries, or at least the countries with the highest levels of emissions, would agree on coordinated emissions mitigation. They both propose that parties to such a hypothetical agreement would put in place a certain carbon price or other non-price-based policies delivering the same emissions reduction as said carbon price. Both initiatives present different scenarios, some with either different but coordinated carbon prices (or equivalent policies) by country or with a unified carbon price (or equivalent policies).

These two initiatives would have two key advantages. First, they could be designed to limit global emissions at a level compatible with the Paris Agreement’s objectives. Second, such agreements could be a suitable alternative to more unilateral measures such as border carbon adjustments (BCAs): by construction, they would impose a convergence in mitigation efforts across countries and, therefore, theoretically limit or even eradicate the risk of carbon leakage.

Reaching such agreements faces significant political and practical hurdles, however:

| 1. They require certain countries to make more stringent mitigation efforts than are present in their current nationally determined contributions. This represents a departure from the Paris Agreement’s principle of countries determining their climate ambitions independently. |

| 2. Under scenarios with a single carbon price (or equivalent policies), all countries would agree to a similar level of mitigation efforts. This may be seen as a departure from the principle of “common but differentiated responsibilities and respective capabilities.” |

| 3. Under scenarios with different prices (or equivalent policies), there would be political sensitivity around the criteria used to determine the level of mitigation effort, for example, development levels and historical emissions. Agreeing on a politically fraught framework, for which the financial stakes are so high, would demand a long and complex international process. |

| 4. Under scenarios with differentiated pricing (or equivalent policies) by country, countries with higher ambition may still face some risk of carbon leakage. The actual leakage risk would depend on the scale of divergence allowed under the framework. The WTO study found only a modest loss of exports under its differentiated carbon price model, peaking at 5% in the highest-price region (but such results are necessarily sensitive to the parameters set up in the models). |

| 5. Every national carbon pricing regime (or lack of regime) is the product of long and hard-fought domestic political battles and compromises, and each country’s regime design (not just price level, but also scope of coverage, competitiveness protections, available offsets, etc.) reflects its unique political, economic, environmental, and historical circumstances. In the foreseeable future, it is hard to imagine countries significantly revising those domestic regimes in the service of international cooperation on leakage prevention. |

While these initiatives constitute important thought experiments on how to mitigate emissions globally in a coordinated way and reduce the risk of carbon leakage, they face significant political challenges in the near term.

In the absence of such first-best solutions, countries will adopt different policies to mitigate carbon leakage. This article discusses three such options for carbon leakage mitigation: BCAs, subsidies and free allocation, and product standards. It emphasizes the trade-offs they each pose for the countries implementing them and, crucially, their trading partners.

The Rise of BCAs

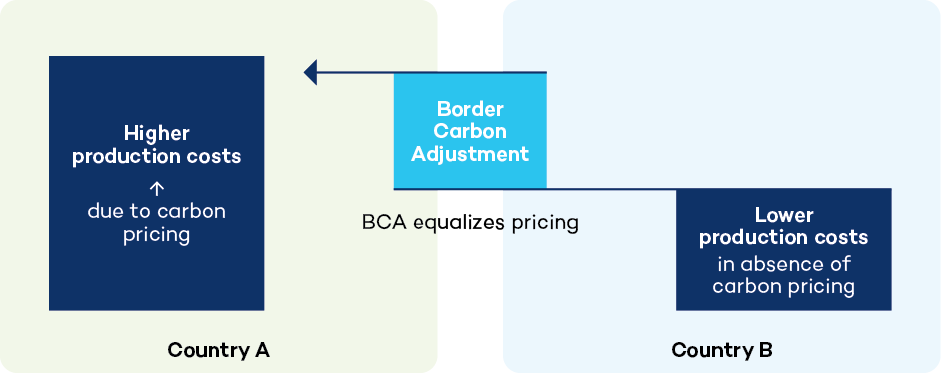

Figure 5. Border carbon adjustments impose fees on imports-embedded emissions

BCAs levy charges on imports to make those goods pay a carbon price equivalent to what they would have paid had they been produced in the implementing jurisdiction. They can also include adjustment at the point of export or rebates of the domestic carbon price.

BCA is increasingly being used to prevent leakage. In the EU, the Carbon Border Adjustment Mechanism will begin charging imports for their embedded emissions as of 2026. The United Kingdom has also indicated it will have a BCA by 2027. Australia has commissioned an independent assessment on whether BCA is needed, and Canada wrapped up a similar consultation in 2022. The United States has four proposals before the current session of Congress for border charges related to carbon content.

As a general proposition, BCAs can be effective at protecting against carbon leakage from imports, but they also come with important limitations. Unless they rebate the domestic carbon price for exports, however, they will not protect against leakage in foreign markets (whereby exports from the jurisdiction imposing a carbon price lose market share in third markets to exports from other countries that don’t price carbon as heavily, or at all). This is a problem if the covered sectors have significant export profiles. However, export rebates have their own challenges. Exempting the exported portion of production from carbon pricing weakens the incentives that the carbon price is supposed to transmit. Moreover, export rebates may be considered prohibited subsidies under WTO law, particularly if the domestic carbon pricing regime is a regulatory measure, such as a cap-and-trade regime.

BCA also suffers from an inherent tension of proper calibration of coverage along the value chain. If it covers not just basic materials but also downstream goods, it will more effectively prevent leakage. Otherwise, domestic producers paying a carbon price will simply lose market share to imports that are just beyond the scope of BCA coverage. But the further down the value chain coverage extends, the more complex and costly it is to administer the regime. Complex goods are the product of many inputs from multiple countries, and tracking embodied carbon along complex value chains can become too troublesome and costly just for the sake of leakage prevention. The trade-off is especially significant because the risk of leakage diminishes further down the value chain, as most carbon is embodied at the level of basic commodities, so even as administrative challenges increase, the benefits in terms of leakage prevention decrease.

Another challenge arises from the risk of so-called resource shuffling. This occurs when trade patterns shift so that cleaner production is exported to jurisdictions with a BCA, and dirtier production goes to other destinations, but there is no change to the prevailing greenhouse gas (GHG) intensity of foreign production patterns. Resource shuffling can be prevented by assessing the GHG intensity of goods based on national averages or other defaults rather than actual data from individual producers. However, that practice also has problems. It penalizes producers that are “cleaner” than the baseline and rewards any producers that are “dirtier.” It may also be illegal under WTO law. Both problems might be at least partially addressed by a regime that used defaults but allowed individual producers to challenge those defaults with actual data.

Carbon Cost Containment and Subsidies

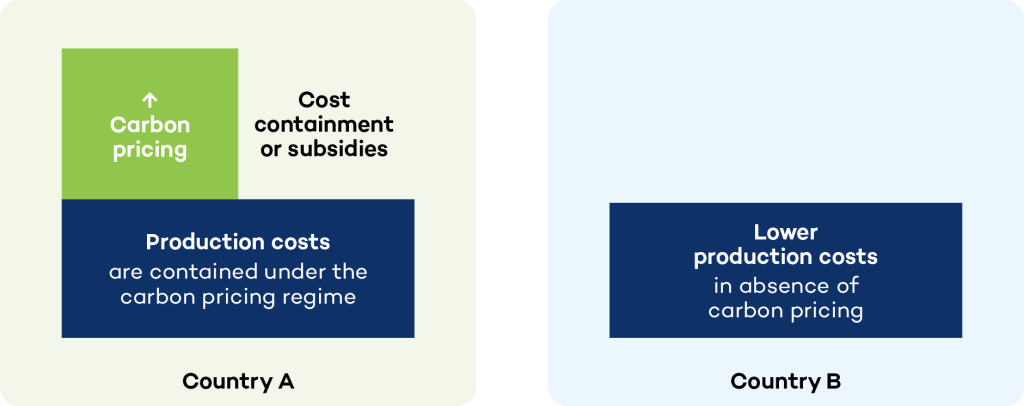

Figure 6. Carbon cost containment and subsidies lower production costs

Carbon Cost Containment

The most prevalent tool to prevent carbon leakage currently consists of various cost-containment measures linked to carbon pricing. In jurisdictions with ETS, these have the common characteristic that operators are liable for emissions-related costs only if they emit above a certain baseline. Typically, sectors deemed at risk of carbon leakage have higher, i.e., more lenient, baselines than others. In jurisdictions with carbon taxes, cost containment typically comes through tax exemptions, often conditional on environmental performance or vulnerability to leakage. We focus here on ETSs, as they cover most emissions subject to explicit carbon prices in 2024.

The most prevalent tool to prevent carbon leakage currently consists of various cost-containment measures linked to carbon pricing. In jurisdictions with ETS, these have the common characteristic that operators are liable for emissions-related costs only if they emit above a certain baseline.

The point of the ETS-related carbon cost-containment mechanisms is that even though the covered firms effectively get rebated the cost of carbon for a large portion of their emissions (protecting against leakage), the carbon price still provides incentives. Every tonne of reduced emissions still earns tradable carbon credits that can be sold, and every additional tonne of GHGs emitted is still an additional liability of the full carbon price. Carbon cost containment in Canada’s Output-Based Pricing System (OBPS) is described for illustration in Box 1. Other carbon pricing schemes, such as Australia’s Safeguard Mechanism and the ETS regimes in the EU, the UK, and Korea, also use such approaches to address carbon leakage.

Drawbacks for jurisdictions implementing carbon cost containment as part of ETS are twofold: first, the incentives to decarbonize might be weaker compared to a system without cost containment. There is conflicting evidence about this, yet it has been found that in some cases, firms receiving more free allocation decarbonize less. Lack of incentive to decarbonize may arise if firms predict their carbon credits will have relatively low values—that is, if firms predict that the credits they earn for beating the benchmark will be worth very little in future carbon markets. There are solutions to this problem, including, for example, so-called carbon contracts for difference. The second issue from the perspective of the producer is political: these cost-containment measures mean lower public revenue.

For their trading partners, carbon cost-containment measures might result in unjustified promotion of firms by the countries implementing them. This was at the core, for example, of the countervailing measure adopted by the United States against higher levels of free allocation provided to firms most at risk under the Korean ETS.

Subsidies

A broad range of subsidies can mitigate carbon leakage. These can be, for example, grants, below-market interest rate finance, purchase of inputs at above-market rates, exemptions or credits of tax revenue or charges otherwise due, or provision of inputs or infrastructure at below-market rates.

Subsidies targeted at lowering producers’ emissions intensity can reduce the costs of compliance with carbon pricing, lowering the risk that such pricing will lead to a loss of market share to foreign producers facing no or low carbon prices. In 2021, the Canadian government, for example, granted Algoma Steel a CAD 420 million subsidy to phase out coal-fired steelmaking processes at one of its mills, meaning that the mill faces lower carbon costs and thus lower risk of carbon leakage.

However, such subsidies are a partial and costly tool for leakage prevention. They are partial because they can only remedy that problem in specific cases of support rather than generally. Moreover, even if they lower the domestic costs of carbon pricing by supporting decarbonization, they do not generally reduce those costs to zero. The use of subsidies as a leakage prevention tool is only available to a rather narrow range of governments that have fiscal space to do so. Retrofitting just one steel mill from GHG-intense to clean production methods can cost nearly CAD 2 billion.

Subsidies can address specific market failures such as technology uncertainty, the need for specific inputs or infrastructure to make decarbonization work (coordination problems), uncertainty about the future value of carbon credits, etc. And that decarbonization, in turn, reduces the risk of leakage. But as tools for the prevention of leakage, subsidies by themselves face daunting challenges. They are perhaps best thought of as complements, not substitutes, for other policy tools.

Product Standards

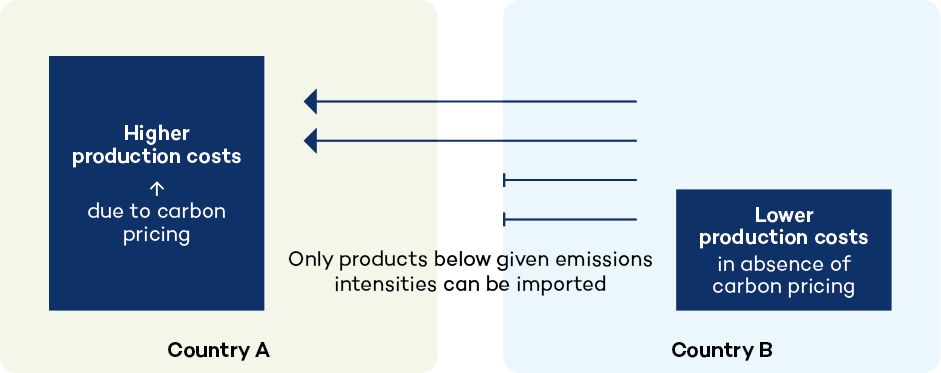

Figure 7. Product standards set limits to emissions intensities of imports

Product standards as a tool to prevent leakage would take the form of mandatory standards (technical regulations) that would not allow goods to be sold on the domestic market if their GHG intensity was above a certain level. This would apply to both domestically produced goods and imports.

Product standards are in force in a few locations, such as the Clean Fuel Standard in force in Canada, which is applied only to fossil fuels. They have been explicitly considered as tools for leakage prevention in the leakage/BCA consultations in the United Kingdom and Australia.

Like BCA, product standards would prevent carbon leakage via imports to the domestic market. Also like BCA, they would do nothing to protect against the prospect of leakage in a jurisdiction’s export markets. One way to address this failure would be to adopt such standards not as a unilateral tool but as a platform for international cooperation. The more countries agree to enact such standards, the lower the risk of leakage between producers selling the same product in global markets. That sort of convergence would be challenging to achieve and would probably have to involve some means of recognition of different stringency of standards in different countries, at least at the outset.

Product standards are a relatively blunt instrument for addressing leakage risk, offering no incentives to improve beyond the level of the standard and no means to achieve market access other than lowering GHG emissions intensity to the specified level. This could be addressed by a regime design that charged for carbon intensity above the standard, rather than acting as a ban; a hybrid of a BCA and a standards-based model. More flexibility might be introduced by making it a tradable standard and/or allowing offsets.

Presumably, the standard would have to be set to become more stringent over time. Setting the level of the standard would be a technical challenge. To set standards at achievable levels, regulators would have to forecast the future of technology development and costs. An unachievable or prohibitively costly mandatory standard would run the risk of simply shutting off access to the covered goods and/or diverting all domestic production to export.

One Size Doesn’t Fit All

All carbon leakage tools present trade-offs regarding impacts on decarbonization, competitiveness, public finances, and administrative complexities. Many of them also impose costs on trading partners and create risks of regulatory fragmentation.

There are risks that governments applying these tools don’t sufficiently consider or reflect developing countries’ interests in their design and that the tools can be designed to serve protectionist objectives rather than to support meaningful climate agendas.

It is important to note that different instruments are not equally available to all governments: BCAs without export rebates would probably be ineffective for very export-oriented countries. Some countries may lack the fiscal space for subsidies or the administrative capacity for complex product standards.

A meaningful international conversation about the use of such tools would help to find a more harmonious approach and explore the full extent of the impact that existing measures are already having—not only on global decarbonization efforts but across borders and onto global value chains.

You might also be interested in

To Reduce Global Plastic Pollution, Governments Should Tackle Most Problematic Products First

The relentless flow of plastic into the global ocean—already a threat to marine life and ecosystems—is on track to rise further, in large part because experts project that plastic production worldwide will double over the next two decades—which in turn would fuel a tripling of the amount of plastic waste entering the ocean each year.

Source to Sea: Integrating the water agenda in 2023

2023 could prove to be a definitive year for facilitating an integrative perspective on water issues, from fresh water to the marine environment.

Commerce des espèces menacées : la COP 19 prévoit de réglementer plus de 500 espèces supplémentaires (in French)

La 19e Conférence des parties à la Cites se termine sur un bilan plutôt positif en prévoyant de réglementer le commerce de plus de 500 espèces supplémentaires. Mais cela signifie aussi que le nombre d'espèces menacées augmente.

Battling to define success after the WTO summit

It’s a little over three days after the World Trade Organization ministerial came to an agreement as dawn broke over Lake Geneva, and I’m sure some attendees are still catching up on sleep. There’s been a veritable banquet since of hot takes for you to choose from. Among the more thoughtful and optimistic are this thread from academic and former WTO official Nicolas Lamp and this on the fishing subsidies issue from piscine guru Alice Tipping. In today’s main piece I talk with Ngozi Okonjo-Iweala, the institution’s director-general, who was very pugnacious indeed in declaring the ministerial a success, and muse on a couple of themes about how negotiations work and what they mean.