Why Canadian Liquefied Natural Gas Is Not the Answer for the European Union’s Short-Term Energy Needs

The Bottom Line: Unpacking the future of Canada's oil & gas

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This policy brief is part one of The Bottom Line series, which digs into the complex questions that will shape Canada's place in future energy markets. (Download PDF)

Summary

- Canada has no ready liquefied natural gas export infrastructure, and it will take at least 3 years before new projects come online.

- Dependence on Russian gas supplies has the EU looking for supplies to fill immediate needs before winter 2022.

- Due to climate commitments and energy security concerns, Europe is accelerating its plans to reduce gas use by ramping up energy efficiency and the use of renewable energy sources. While there may be demand for some fossil fuels, markets like Norway are more logical to fill immediate needs.

- This results in a fundamental mismatch with Canadian supply opportunities. Canada cannot ramp up supply before 2025, while Europe’s energy needs will largely be resolved by that time.

- High prices and energy security concerns, combined with climate commitments, suggest that new Canadian liquefied natural gas infrastructure would be at risk of becoming stranded.

The Russian invasion of Ukraine has led to a global energy crisis that has caused already-high gas and oil prices to rise even more, with huge consequences for people and societies across the globe.

In response, the Canadian government recently stated that Canada would aim to increase domestic oil and gas production by 200,000 bpd and 100,000 barrels of oil equivalent per day (boepd), respectively, before the end of the year. This includes discussions with Germany and Spain regarding the development of liquefied natural gas (LNG) facilities that would allow Canada to export gas to European countries in the future.

However, despite recent requests to support the immediate needs of Germany, Canadian LNG infrastructure cannot be scaled up in time to meet Europe’s short-term needs. An examination of the EU’s medium-term (1–4 years) plans to become independent of Russian gas shows that overall demand for gas will be rapidly declining by the time new Canadian export facilities can come online. In addition, the current high prices and insecurity of supply have caused the International Energy Agency (IEA) to scale back projected increases in global demand for gas. As a result, investment in new Canadian infrastructure, especially infrastructure intended for European markets, risks being stranded.

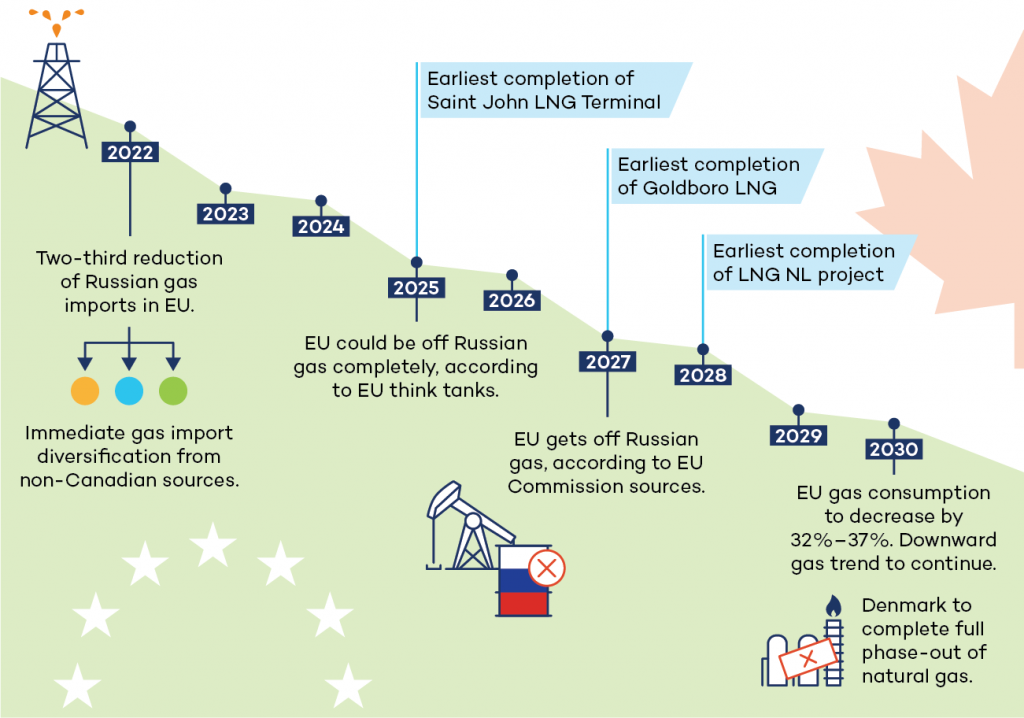

Figure 1. EU phase-out of Russian gas compared with proposed Canadian LNG projects

Canada Has No Overseas LNG Export Infrastructure

In 2020, Canada was the world’s 5th largest producer of gas, responsible for around 5% of global supply. Only the United States, China, Iran and Russia produced more. The majority of gas produced in Canada is used domestically, with the remainder exported almost exclusively to the United States. Compared to oil, gas is not easy to ship and is mainly transported via an extensive pipeline network that is interconnected with the United States. Since Canadian gas is mainly produced in British Columbia, Alberta, and Saskatchewan, eastern Canada imports gas from the United States. Although numbers vary year over year, in 2020 Canada produced 3.9 trillion cubic feet of gas and exported 2.4 trillion cubic feet.

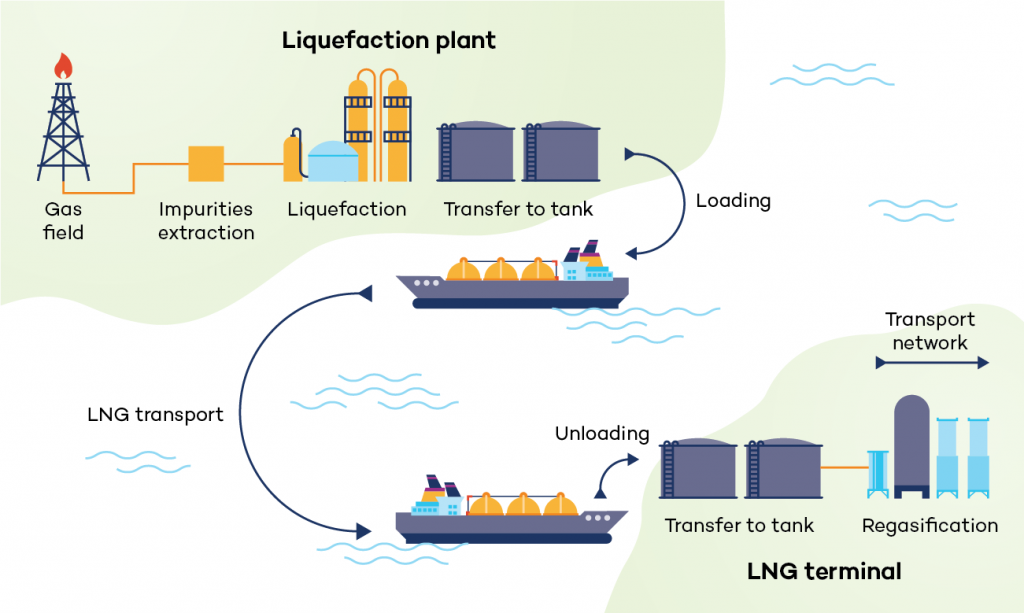

Over the past two decades, gas markets across the world have started to better integrate due to increased demand and higher prices that have allowed for transportation of gas via marine shipping. This requires specialized facilities to cool the gas to a liquid state, transportation on specialized tankers, and regasification facilities so that the gas can be again distributed via pipelines at its import destination.

Figure 2. LNG shipping process

Canada has one LNG import facility, Canaport LNG in Saint John, New Brunswick, which is owned by Madrid-based Repsol. Although there have been many LNG export facilities proposed and approved over the last decade, due to low LNG prices and inability to access finance, nearly all have been cancelled or postponed. As a result, Canada has no operating LNG export infrastructure.

LNG Canada, under construction in Kitimat, British Columbia, will be Canada’s first completed export facility. Led by Royal Dutch Shell and scheduled to come online in 2025, the USD 30 billion project is intended to serve Asian markets. It will connect to the Coastal GasLink pipeline, a 650 km pipeline that continues to be contested by the Wet'suwet'en Hereditary Chiefs. To support project completion, the federal government has already provided subsidies including a direct investment of CAD 275 million and steel tariff exemptions worth CAD 1 billion. This is in addition to the significant subsidies offered by the BC government via the BC–LNG Canada Agreement. Export Development Canada has also provided the Coastal GasLink pipeline with CAD 500 million in loans.

Meanwhile, over the past decade, there have been several other failed attempts to develop LNG shipping facilities in Canada. This includes mainly projects in British Columbia for the Asian market, but also projects in central and Atlantic Canada. Although some projects, like Energie Saguenay in Quebec, have been rejected by governments, most delayed or abandoned projects have floundered due to low global LNG prices and a lack of access to finance.

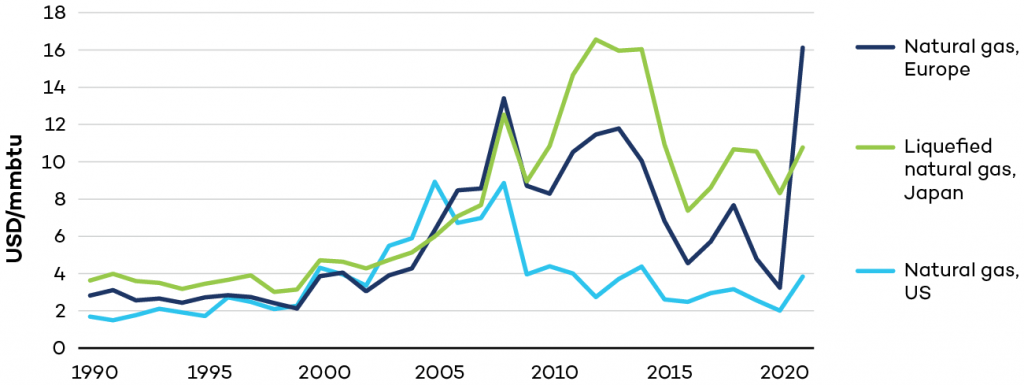

Despite occasional spikes, gas prices in the European and U.S. markets have historically been much lower than what we have seen in 2021 and 2022. Since 2000, gas prices have fluctuated between 2 and 12 USD/MBtu (see Figure 3), far lower than record high prices in 2022, which in Europe reached more than 50 USD/MBtu.

According to the IEA, recent price spikes are due to a range of specific temporal factors, including strong economic recovery after COVID-19 lockdowns ended and colder-than-average temperatures that increased demand for LNG around the world. Likewise, low gas prices in 2020 facilitated a large uptake of coal-to-gas switching that further helped increase demand for gas. These trends were accompanied by record levels of supply-side capacity outages and upstream underperformance that also played a role in limiting supply. Nevertheless, the IEA expects global LNG price volatility to somewhat stabilize over the course of 2022, with European and Asian prices remaining in the range of 26–28 USD/MBtu through to the end of the year.

Figure 3. Regional gas prices 1990–2021

The EU Will Be Onto Cleaner Alternatives Before Canada Can Deliver LNG

The Russian invasion of Ukraine has underlined the fact that the EU has been extremely dependent on Russian fossil fuels. In 2021, the EU imported more than 40% of its gas (and almost a third of its oil) from Russia. In 2021, gas imports from Russia equalled 155 billion cubic metres (bcm) in absolute terms.

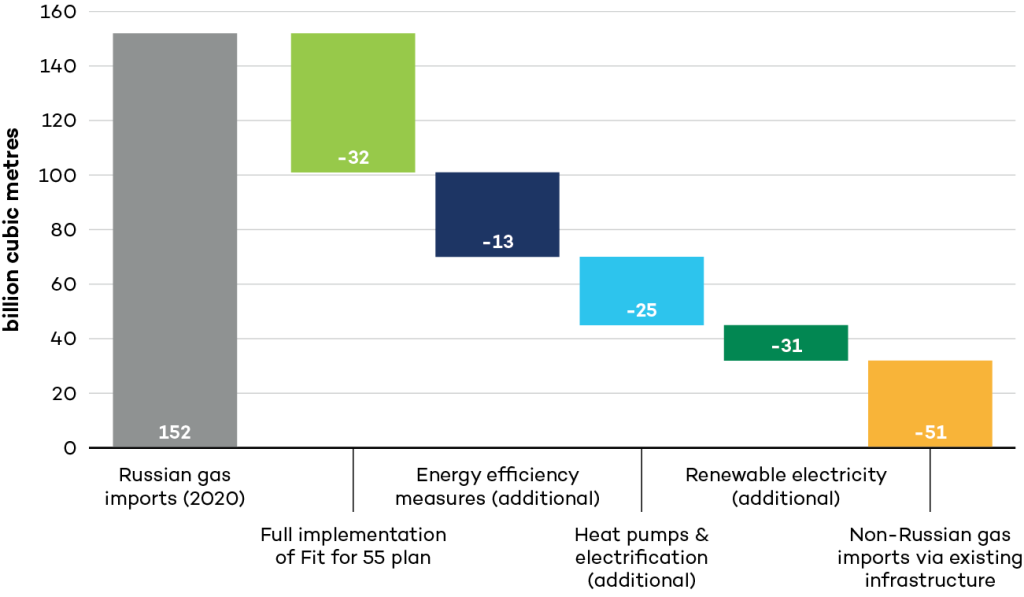

However, over the past decade, the EU has also progressively raised its climate targets. The European Climate Law sets a binding target of climate neutrality by 2050 and an emissions reduction target of 55% by 2030. Further, as part of its implementation proposal for the Climate Law, the “Fit for 55” package includes a range of ambitious targets. As a result of these policies, final EU gas demand is projected to decrease by 32%–37% by 2030.

Russia’s invasion of Ukraine has only strengthened the EU’s commitment to reduce its reliance on fossil fuels. Although it does not yet include a complete timeline for getting off gas completely, the EU’s REPower response to the war accelerates and strengthens all major initiatives from the Fit for 55 package with the intention of reducing Russian gas imports by two-thirds before the end of this year.

For example, it speeds up 420 GW solar photovoltaic deployment plans by 20% and increases existing targets in the Fit for 55 plan by 80 GW of wind and solar capacity. The REPower plan also proposes to double the rate of heat pump installation to 10 million units over the next 5 years, which would reduce gas demand by 1.5 bcm this year, while at the same time proposing to increase the production of biomethane in Europe.

The plan also includes immediate efforts to replace Russian gas with shipped imports of around 50 bcm from the United States, Qatar, West Africa, and Egypt. In addition, it expects pipe source diversification with increased imports from Algeria, Norway, and Azerbaijan to deliver around 10 bcm yearly.

“The goal is to slash EU demand for Russian gas by two thirds before the end of the year, and to make Europe independent from Russian fossil fuels by 2027.”

Overall, the plan concludes that the EU can phase out Russian gas “well before 2030,” with the EU’s Economic Commissioner, Paolo Gentiloni, suggesting that they could be completely off Russian gas by 2027.

Although the EU plans to get off Russian gas are widely recognized as ambitious, independent analysis concludes that the EU could phase out Russian gas imports in 2025 by implementing the Fit for 55 package and introducing additional measures on energy efficiency, heat pumps, and renewable energy supply. The remaining gas requirements of 51 bcm per year could then be replaced via imports through existing gas infrastructure.

Figure 4. Potential replacement of Russian gas by 2025

Analysis showing how the EU can accelerate the transition away from gas has been supported by thought leaders and the actions of member states. Eleven former EU policy chiefs have warned that “simply diversifying the import of fossil fuels will only serve to maintain EU energy dependence on other countries,”. Similarly, in April, 11 EU member states (Denmark, Austria, Germany, Spain, Finland, Ireland, Luxembourg, Latvia, the Netherlands, Sweden, and Slovenia) called for accelerated negotiations to phase out Russian gas while also citing the need to avoid any lock-in of greenhouse gas emissions.

National-level plans and analyses for member states, including Germany, Italy, and Denmark, show how phasing out Russian imports will be accomplished, in part, by an accelerated transition away from gas (Holz et al., 2022). Noting these dynamics, one of Germany’s leading economic institutes, DIW Berlin, has said that “building fixed LNG terminals in Germany … does not make sense because of the long construction times and the sharp decline in natural gas demand in the medium term” (Holz et al., 2022).

This is in line with the IEA’s recent gas outlook. Due to high prices, energy security concerns, and accelerated demand reduction, the outlook lowered projections for global gas demand in the medium term (2022–2025). Although the long-term impact of the current situation is still unknown, energy efficiency and fuel-switching in the next several years will significantly reduce demand for LNG in the EU.

“Simply diversifying the import of fossil fuels will only serve to maintain EU energy dependence on other countries.”

Canadian LNG Infrastructure Can’t Be Scaled Up in Time

The EU is looking for gas supplies to meet immediate demand but is also planning for structural transformation to its energy system that has the potential to phase out Russian gas over the next 3 to 5 years. Nevertheless, in Canada, high prices and the short-term supply crunch have ignited interest in reviving or fast-tracking LNG proposals in the Atlantic provinces.

In particular, three projects are being discussed:

LNG NL

LNG Newfoundland and Labrador has proposed a 5.5 USD billion project in Newfoundland and Labrador that would liquefy gas from offshore oil production to produce around 2.6 million tonnes of gas per year. Due to recent events, LNG Newfoundland and Labrador has suggested fast-tracking the project so that exports begin in 2028 instead of the current 2030 timeline.

Goldboro LNG

Calgary-based Pieridae’s proposed Goldboro project in Nova Scotia was originally abandoned on financial grounds (including a rejected call for USD 1 billion subsidy) in the summer of 2021. Recently, the company has revised the project, proposing a floating terminal that would be able to produce around 2.5 million tonnes of LNG per year from around 2025 (around 3.5 bcm). The proposal enjoys some support from local municipalities, but the province has stated that a substantially revised project would need to apply for regulatory approval before construction could begin. Pieridae has indicated that the project would not be operational until 2027.

Saint John LNG Terminal

Repsol has revived a plan to build an export terminal at its existing import facility, in New Brunswick. This project was initially shelved in 2016 when the proponents could not attract investors and concluded that the expansion was not economically viable.

Of the three, the Repsol project is the frontrunner for early completion because there is an existing facility in place. However, estimates for completion still range from 3 to 5 years, and LNG facilities have a poor track record for delays. Importantly, both the Goldboro and the Repsol projects would need additional pipeline capacity to supply gas for export and would need to source gas from the United States or via additional pipeline volumes through Quebec. Expanding fossil fuel infrastructure in Quebec would likely be met with public opposition, which could add time and expense to the project. In addition, directing existing supply to export raises questions about whether export contracts will conflict with supplying gas to meet domestic demand.

Canada has little experience in building LNG export facilities. However, most U.S. LNG facilities have taken more than 4 years to complete after the final investment decision. “According to McKinsey, a final investment decision, or FID, is “the point in the capital project planning process when the decision to make major financial commitments is taken. At the FID point, major equipment orders are placed, and contracts are signed for [Engineering, Procurement, and Construction].” While pre-FID projects are typically considered proposals that may or may not advance, a positive FID indicates that a project is likely to be built”.

Only two projects were carried out within a three-year timeline and these were both expansions of existing facilities. This does not include time to secure regulatory approvals. As a result, it is not realistic that new Canadian LNG export projects could be commercial in time to meet Europe’s immediate gas needs.

Canadian LNG Is Not the Solution for the EU’s Desire to Get Off Russian Gas

The EU is moving swiftly to slash dependence on Russian fossil fuels—especially gas. However, this is a structural transformation that will reduce overall demand for gas. The EU’s response to the crisis will lead to a strengthening of those trends that have been present across member states for some years now, including a significant ramping up and support of clean energy and ambitious climate targets for implementation.

At the same time, high prices and a renewed concern for energy security suggest that in the medium term, demand will be lower than expected—not just in Europe but globally.

New Canadian export facilities will take a minimum of 3 years to complete, and possibly much longer. This means that as any new Canadian infrastructure is coming online, European demand will be dropping. A faster-than-expected transition away from gas in the EU risks stranding assets that are built explicitly to supply that market. There is also the risk that global gas markets will continue to be volatile and unpredictable, with current high prices and the imperative to reduce greenhouse gas emissions also leading to an accelerated transition away from gas in non-EU markets.

Naturally, Canada is considering how to best support the energy needs in Europe. Building new LNG infrastructure is not the solution. There is a fundamental mismatch between Europe’s immediate need to diversify gas supply and the 3-to-5 year timeline for scaling up Canada’s LNG exports. Canada cannot get new LNG infrastructure in place in time to help Germany and other allies, and attempts to do so risk stranding emissions-intensive infrastructure at a time when the clean energy transition is accelerating.

A full list of references can be found here.

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This publication is part one of The Bottom Line policy brief series, which digs into the complex questions that will shape Canada's place in future energy markets.

You might also be interested in

In Search of Prosperity: The role of oil in the future of Alberta and Canada

This report assesses the market outlook for Alberta’s oil sector, using new modelling and a comprehensive analysis of eight key factors affecting the sector’s future.

Federal Fossil Fuel Subsidies in Canada: COVID-19 edition

Federal fossil fuel subsidies in Canada reached at least CAD 1.9 billion in 2020 in part due to responses to COVID-19.

Pipelines or Progress: Government support for oil and gas pipelines in Canada

Oil and gas pipelines in Canada have received over CAD 23 billion in government support since 2018.

Lighting the Path: What IPCC energy pathways tell us about Paris-aligned policies and investments

This report analyses the latest IPCC pathways limiting warming to 1.5°C and offers key policy recommendations on oil and gas phase-out timelines, renewable energy deployment, and investment policies.