Why Liquefied Natural Gas Expansion in Canada Is Not Worth the Risk

The Bottom Line: Unpacking the future of Canada's oil & gas

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This policy brief is a part of the The Bottom Line series, which digs into the complex questions that will shape Canada's place in future energy markets. (Download PDF)

Summary

- New liquefied natural gas (LNG) facilities will undermine Canada’s domestic and international climate commitments through increased upstream and midstream emissions and—more critically—by diverting scarce financial and clean energy resources toward fossil fuel production and away from more cost-efficient decarbonization efforts.

- The possibility of coal-to-LNG switching abroad should not be used to justify the inevitable increase in domestic emissions associated with expanding LNG production. While proponents argue that LNG exports will decrease global emissions by replacing coal consumption overseas, this climate benefit is uncertain and often overstated, in part because of LNG’s potential to crowd out investment in renewable energy.

- The economics for new LNG production are weakening, as demand is estimated to have already peaked in advanced economies such as Europe and South Korea; LNG demand growth in emerging Asian markets is also projected to slow.

- By the time Canadian LNG from most new facilities reaches markets near the end of the decade, global LNG supply is expected to have already outpaced demand, deflating global prices. As a result, Canadian LNG projects may struggle to compete with cheaper and incumbent producers—such as Qatar and the United States—without substantial public subsidies.

- To limit the risks to taxpayers, the economy, and the climate, Canadian governments should avoid issuing project approvals and export licences to new LNG projects while phasing out subsidies and other forms of public support for approved projects.

Introduction

Canada produces more natural gas than is necessary for domestic demand, with over 40% of production exported between January 2020 and July 2023. To support the expansion of export markets beyond the United States, there are several active projects and proposals to construct liquefaction facilities in Canada that would convert feedstock gas into liquefied natural gas (LNG) to be exported overseas. While some of Canada’s gas has recently been sold to operators of liquefaction terminals in the United States—indirectly expanding Canadian export markets—the proposed domestic terminals are intended to enable Canadian gas to be exported overseas directly.

Following an analysis of the most recent evidence, however, this brief concludes that plans to produce LNG in Canada carry excessive economic and environmental risks. Most prominently, Canadian LNG from most new facilities is at risk of entering the market during a global glut in supply, hampering the potential for export investments to be profitable and ultimately leaving investors at risk of losses from stranded assets. Meanwhile, excess LNG on the global market threatens to drive down prices and undercut the expansion of renewables abroad. Moreover, a Canadian LNG industry will come at the cost of increased domestic emissions that threaten to undermine Canada’s climate obligations. Accordingly, Canadian governments should limit exposure to such risks by refraining from issuing new construction and export permits while phasing out subsidies and other forms of financial support currently allocated to LNG projects.

Other countries are also beginning to acknowledge the risks of LNG expansion. Earlier this year, the Biden administration announced a pause on granting new LNG export licences to non-free trade agreement countries. The rationale was the need to better integrate economic and environmental risks into the approval process, following "an evolving understanding of the market need for LNG, the long-term supply of LNG, and the perilous impacts of methane on our planet." While this policy development in the United States will not directly affect Canadian producers, it does acknowledge the need to examine the overall costs and benefits of LNG expansion in a rapidly changing global market.

Reconsidering Canadian LNG Projects

Canada currently does not have any major LNG export facilities. However, eight projects are in various stages of consideration or construction, according to the federal government. Most of these are in British Columbia (BC), with one under consideration in Newfoundland and Labrador (see Table 1). West Coast LNG projects generally aim to supply Asian markets while the Newfoundland LNG projects would target sales to Europe. The largest and most advanced project is LNG Canada’s Phase 1, which is scheduled for completion in 2025. Woodfibre LNG, the only other project in Canada that has begun construction, is expected to be complete in 2027. Most other projects are scheduled for completion by or around 2030, though all are awaiting final investment decisions, environmental impact assessments, and/or export licences (Table 1). If approved, these pending LNG projects could have projected lifespans ranging from 20 to 60 years, depending on the project. As such, decisions on LNG expansion must be taken with a balanced view of their associated economic and environmental risks in the long term.

| Project (location) | Export capacity (MTPA3) | Export licence | Government approvals | Final investment decision | Construction status |

| LNG Canada Phase 1 (Kitimat, BC) | 14 | 40 years | Approved | Approved | Begun; to be completed in 2025 |

| LNG Canada Phase 2 (Kitimat, BC) | 14 | 40 years | Approved | Pending | Not started |

| Woodfibre LNG (Squamish, BC) | 2.1 | 40 years | Approved | Approved | Begun; to be completed in 2027 |

| Ksi Lisims LNG (Gingolx, BC) | 12 | 40 years | Pending | Pending | Not started |

| Tilbury LNG Phase 2 (Delta, BC) | 2.5 | 25 years | Pending | Pending | Not started |

| Cedar LNG (Kitimat, BC) | 3 | 25 years | Pending | Pending | Not started |

| Port Edward LNG (Port Edward, BC) | 0.3 | Short term | Pending | Pending | Not started |

| Grassy Point LNG (Placentia Bay, NL) | 2.5 | Yet to apply | Pending | Pending | Not started |

Sources: Authors, based on data from BC Environmental Assessment Office, 2024; Cedar LNG, 2024; Natural Resources Canada, 2023; Nickel, 2024; Woodfibre LNG, 2024.

Environmental Risks of LNG Expansion

LNG Production Would Threaten Canadian Climate Goals

LNG production emits greenhouse gases (GHGs) at all stages of the value chain (Figure 1), posing an inherent challenge to aligning Canada’s plans for LNG expansion with domestic climate goals. Indeed, Clean Energy Canada calculates that just the six most advanced LNG projects in BC could add 13 Mt of carbon dioxide equivalent (CO2e) annually to Canada’s emissions by 2030. The Pembina Institute estimates that these upstream and midstream emissions would result in BC's oil and gas sector emitting a total of 30 Mt CO2e in 2030. This is more emissions than every gas-powered passenger car in Canada emitted in 2021 (25 Mt CO2e) and would breach BC’s sector-specific emissions target by 200%. This long-term fossil fuel infrastructure risks becoming stranded before the end of its economic life cycle if Canada reaches net-zero emissions by 2050. New LNG infrastructure may also create a fossil fuel lock-in effect by increasing the economic and political costs of meeting Canada’s climate commitments relative to a scenario where excess fossil fuel infrastructure is not developed.

Figure 1. Illustrative life-cycle emissions of LNG5

Source: Authors’ graphic based on data from Nie et al., 2020.

Recognizing the emissions entailed by LNG expansion, both LNG proponents and the BC government have often suggested that LNG production in new facilities could be net-zero by 2030. However, significant resource constraints will make it difficult to fully decarbonize all planned LNG facilities. Indeed, for most LNG facilities, decarbonization would entail a massive demand for clean electricity that is proposed to come primarily from hydroelectric power sources, such as BC Hydro’s Site C dam, which is currently under construction at an estimated cost of CAD 16 billion. This new dam, however, will be far from sufficient to decarbonize BC’s planned LNG projects, as 2.5 times the hydroelectricity output of Site C would be required just to align LNG Canada Phase 1 and Woodfibre LNG with BC’s oil and gas sector emissions target. It is unclear how BC would produce enough clean electricity by 2030 to align all new LNG facilities in the province with 2030 climate targets.

Even if new LNG facilities could be fully decarbonized, doing so would indirectly undermine Canada’s domestic climate targets by drawing excessively from clean energy supplies. That is, the massive amount of clean electricity required for LNG facilities could otherwise be used to decarbonize existing industries, such as the transport sector, or facilitate alternative growth strategies in low-carbon industries, such as renewable power generation. LNG expansion would therefore commit Canadian governments to the opportunity cost of using clean electricity to reduce future emissions associated with highly energy-intensive LNG facilities instead of reducing current emissions in other sectors. To put this opportunity cost in perspective, Clean Energy Canada estimates that importing the equivalent electricity produced by just one Site C dam would cost approximately CAD 600 million annually.

LNG expansion would therefore commit Canadian governments to the opportunity cost of using clean electricity to reduce future emissions associated with highly energy-intensive LNG facilities instead of reducing current emissions in other sectors.

New LNG Is a Risk to Global Emissions Reductions

Acknowledging the reality of increased domestic emissions driven by LNG expansion, proponents argue that Canadian LNG exports would reduce emissions abroad, thereby generating a net benefit for the climate globally. This is suggested to occur because of coal-to-LNG fuel switching, as Canadian LNG displaces coal use for power generation in target export markets. However, recent studies suggest that this relationship between coal-to-LNG fuel switching and aggregate emissions reductions is more complicated than previously assumed and thus should not be relied on to justify the inevitable increase in domestic emissions associated with domestic LNG production.

Part of this complicated picture is that rates of fugitive methane emissions—those that are unintended and typically unmeasured—are much higher throughout the natural gas supply chain than previously believed. For example, methane emissions from oil and gas production in Canada have been consistently underestimated, with two recent studies estimating methane emissions to be 50% and 90% above official reported figures, respectively, at sites under evaluation. While the exact magnitude of methane emissions will differ by project, and the forthcoming federal methane regulations would reduce emissions in Canada, it is unlikely that methane emissions will be eliminated entirely from LNG value chains—especially in parts of the value chain that operate beyond Canada’s jurisdiction. When accurately accounted for in life-cycle emissions comparisons, these higher-than-assumed methane emissions can weaken or even reverse the assumed climate advantage of coal-to-LNG fuel switching.

Moreover, multi-decade LNG expansion projects may create international energy market conditions that undermine the transition from fossil fuels to zero-emission power sources. That is, infrastructure lock-in and deflated natural gas prices caused by excess supply would create long-term incentives for more natural gas consumption than would otherwise occur. While proponents argue that this increase in supply may displace coal as an energy source, others highlight that lower gas prices may also disincentivize investments in renewable power generation and thus slow the clean energy transition in emerging economies. Indeed, increased LNG supply in the international market will make it more competitive relative to alternatives generally. That includes both coal and renewables. The extent to which switching occurs between LNG and either of these alternatives will ultimately depend on contextual factors—such as policy support—that will differ across importing countries. Accordingly, new long-term LNG projects will incentivize higher global LNG consumption, which may, in turn, displace coal, renewables, or both depending on economic and policy contexts across importing countries. Proponents, therefore, cannot argue with certainty that new LNG exports will reduce global emissions by displacing coal use abroad. Rather, the risk of displacing renewables instead must be fully acknowledged in decisions to support LNG going forward.

Canadian LNG Is a Risk to Global Climate Goals

Given these direct and indirect impacts on global emissions, new LNG production is widely recognized as incompatible with science-aligned emissions trajectories for keeping the average global temperature rise to 1.5°C. The International Energy Agency, United Nations Environment Programme, Intergovernmental Panel on Climate Change, and others have all concluded that there can be no new long-term oil and gas projects—including Canada’s planned LNG expansion—if the 1.5°C temperature target is to be achieved. This conclusion remains true even if LNG is assumed to be less emissions intensive than coal. Moreover, the IEA’s modelling suggests that emissions from oil and gas sector operations must decline by 60% (relative to 2022) by 2030. This modelling does not leave room for the rising emissions expected from LNG expansion projects, as outlined above in the case of BC, for example. New LNG projects, therefore, pose a substantial long-term risk to global climate goals.

Canadian LNG expansion could also have a more immediate chilling effect on global climate ambition. Prioritizing industrial expansion over internationally recognized climate commitments would suggest that Canada is not committed to transitioning away from fossil fuels in line with the Paris Agreement, thereby sending a non-cooperative signal to other countries that may be facing a similar dilemma over fossil fuel expansion. This move is especially risky given Canada’s outsized historical contribution to climate change and the implications that this has for international discussions regarding a just distribution of the remaining global carbon budget. In a time where global cooperation on climate change is critical to implementing the Paris Agreement, the non-cooperative signal that would be sent by Canada prioritizing LNG expansion over its own climate commitments should not be overlooked.

Economic Risks of LNG Expansion

Market Fundamentals Are Increasingly Unfavourable for New LNG Exports

The economics of LNG development are weakening. Even with an optimistic 3–5-year time frame for construction, most Canadian projects would not begin exporting until the end of the decade. By this time, forecasted supply from incumbent producers is already expected to outpace demand. The United States, for example, already the world’s largest LNG exporter, is expected to double its current export capacity, with 102 billion cubic metres (bcm) of new capacity currently under construction. Russia and Qatar also have significant projects underway. Altogether, the IEA estimates that LNG projects under construction and those that have been awarded a positive final investment decision will add 250 bcm per year of liquefaction capacity by 2030—the equivalent of half of today’s global LNG supply. More than half (60%) of this increase is expected to come from the United States and Qatar.

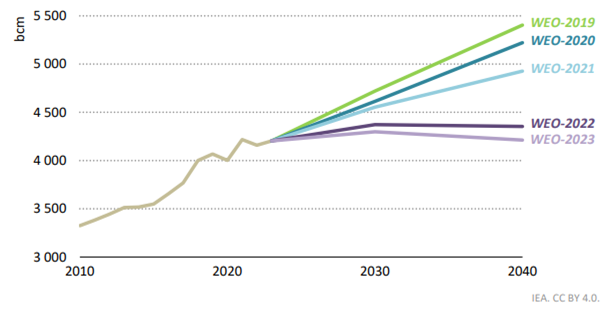

At the same time, medium- and long-term natural gas demand forecasts are being consistently revised downward (Figure 2). Renewable energy capacity has expanded far more quickly than expected—despite growing fossil fuel subsidies—due to falling technology costs and increased climate ambition. Meanwhile, energy demand growth in key markets such as China is expected to slow relative to previous forecasts. LNG imports in Japan also fell by 8% in 2023—to their lowest level since 2009—following the restart of several nuclear power stations and growing renewable power generation. South Korean LNG imports similarly fell almost 5% in 2023, with demand expected to fall through the mid-2030s as new renewables and nuclear power plants come online. In the European Union, natural gas demand is in “structural decline” following a rapid expansion of renewables. Indeed, despite a short-term increase in European LNG demand following Russia’s invasion of Ukraine, the European Union Agency for the Cooperation of Energy Regulators recently confirmed that Europe’s LNG demand is expected to peak in 2024. Finally, volatile LNG prices and delays to import infrastructure projects in emerging markets in South and Southeast Asia are expected to continue dampening future demand.

Figure 2. IEA forecasts for global natural gas demand by year based on current climate policies

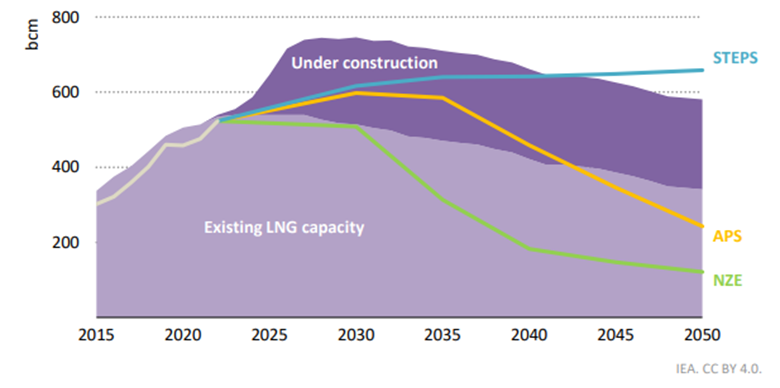

This slowing demand and growing supply will likely lead to an LNG market glut by the time most Canadian export capacity would come online toward the end of this decade. This expectation of a near-term supply glut for LNG is supported by recent market analyses from Morgan Stanley, S&P Global, and the Oxford Institute for Energy Studies. In the medium to long term, moreover, data from the IEA’s most recent modelling suggests that with current climate policies, there is sufficient LNG capacity in operation and under construction globally to meet projected natural gas demand all the way to 2040 (Figure 3). When announced climate policies are modelled, LNG projects under construction today are expected to result in more than twice the necessary capacity required to meet forecasted demand in 2050 (Figure 3).

As a result, the IEA warns that LNG’s market fundamentals are shifting, "[raising] questions about the long-term profitability of projects." The most recent market analysis from the Institute for Energy Economics and Financial Analysis reaches the same conclusion, even when the United States’ recent pause on LNG export licences is accounted for. Indeed, it is precisely this concern for an imminent oversupply of LNG that informed the U.S. government’s decision to pause future LNG export licensing. In the longer term, demand is harder to predict due to a range of uncertainties, including policies across importing and exporting countries. As such, long-term forecasts of LNG demand vary wildly. What is highly likely, however, is that LNG demand in certain advanced, high-consuming economies like Europe and South Korea has peaked. It is clear that high-demand projections in the long term are less compatible with global climate goals, and as such, investment decisions today that bet on the former are likely to materially undermine the latter. The business case for new LNG capacity is therefore already weak for the near and medium terms, and this trend will likely continue into the longer term as global climate ambition increasingly aligns with the Paris Agreement.

Figure 3. Global LNG capacity versus demand under three IEA scenarios

Source: IEA. CC BY 4.0.

Canadian LNG May Struggle to Compete in a Crowded Global Market

The economic viability of Canadian LNG, specifically, will be directly affected by these worsening market fundamentals. Low demand and high supply will deflate global market prices, leaving marginal producers and new projects that have yet to repay their capital investments at risk of being priced out of the market. Canada’s intended importers in emerging Asian markets are price-sensitive and can therefore be expected to choose low-cost producers over more expensive ones—regardless of green credentials. Canadian LNG’s competitiveness and economic viability, therefore, will depend mostly on its production, transportation, and liquefaction costs relative to alternatives—notably from Qatar and the United States.

It will be difficult for Canadian producers to compete on cost against these two alternative exporters. Qatar is by far the world’s lowest-cost LNG producer, which is unlikely to change. Qatar can produce LNG for as little as USD 0.03 per million British thermal units (mmBtu)—compared to the global average of USD 3–5/mmBtu—due to its abundant and easily accessible feedstock natural gas reserves, efficient co-production with natural gas liquids, and low labour costs. When directly compared to U.S. LNG exporters on the Gulf Coast, LNG Canada is estimated to have double the production costs per unit of capacity.

LNG Canada’s comparatively high costs are mostly driven by high capital costs for infrastructure development, as well as transport of natural gas feedstock—and these costs have only increased over time. The result is an LNG project with "razor-thin" margins, ultimately dependent on extremely cheap feedstock gas and a relatively high LNG market price. As discussed above, however, such an economic forecast is unlikely in the near-to-medium term due to the expected oversupply of natural gas globally. Similar cost increases and economic feasibility concerns have also been raised regarding Woodfibre LNG. Meanwhile, all other Canadian LNG projects are awaiting final investment decisions (Table 1). The case for Canadian LNG’s economic competitiveness in a crowded global market therefore remains unconvincing.

Canadian LNG Assets May Become Stranded—With Taxpayers Carrying Much of the Risk

To navigate this challenging economic landscape for new LNG exports, Canadian LNG projects rely heavily on subsidies and public funding. The LNG Canada project, for example, has already received at least CAD 275 million in direct investments from the federal government, alongside approximately CAD 1 billion in steel tariff exemptions. Provincial data also show that the BC government has provided LNG Canada with at least CAD 5.4 billion in various forms of financial incentives. In addition, provincial and federal governments have funded specialized infrastructure projects such as the CAD 16 billion Site C dam and the Coastal Gaslink pipeline that will be used to transfer feedstock gas to LNG facilities, including LNG Canada. Similar subsidies—including steel tariff exemptions and reduced rates for electricity consumption—are also expected to apply to Woodfibre LNG.

The precarious business case for Canadian LNG, in turn, generates economic risk for private investors, public taxpayers (who are contributing through subsidies), participating Indigenous partners, and the local economies in which these projects are being developed. Indeed, the unfavourable market conditions forecast above could result in significant losses for Canadian LNG projects, creating a risk of assets being closed prematurely—thereby becoming stranded. The result would not only be losses for public and private investors but also major economic shocks for the workers and communities that become economically dependent on these projects. In addition, the physical assets themselves would require decommissioning to avoid local environmental damage—the costs of which may ultimately fall on the taxpayer. The Canadian economy is already at significant risk of widespread asset stranding in the oil and gas sector; new LNG projects will add further risk to that portfolio, with much of it carried by taxpayers.

The financial exposure of taxpayers, moreover, may increase over time. If market conditions develop as expected and Canadian LNG projects become at risk of being stranded, then governments may be incentivized to expand subsidies in an attempt to delay the economic and political costs of asset stranding described above. In a competitive international market, LNG producers are likely to rely on substantial government subsidies and public investment to align their production activities with domestic climate targets. The Site C hydroelectric project, for example—electricity from which is essential for decarbonizing LNG Canada—has an estimated project cost of CAD 16 billion that is funded primarily by the Government of British Columbia and increased prices for both residential and industrial BC Hydro consumers. Meanwhile, LNG Canada’s proponents have already suggested that even more government support will be required to fully electrify Phase 2 of the project while maintaining its economic viability.

Implications for Canadian Decision-Makers

Given market uncertainties and known climate constraints, the risks of LNG expansion far outweigh the suggested benefits. Environmentally, Canadian LNG is at odds with domestic climate obligations. Even in a less ambitious climate scenario, there are significant risks that LNG exports will not drive the net reduction in GHG emissions that its proponents claim. Rather, LNG risks either locking in decades more fossil fuel extraction and consumption (displacing investment from renewables in the process) or leaving multi-billion-dollar assets stranded. Economically, the business case for LNG expansion in Canada is tenuous. Consistent downward revisions of LNG demand forecasts in key Asian and European markets, alongside a supply of cheaper exports from Qatar and the United States, suggest that Canadian LNG may be priced out of the market soon after exports begin. The result would be major economic losses for investors, taxpayers, and local communities alike. Considering these risks, public and private investment should instead be driven toward green industries such as renewable power generation and decarbonized transport systems.

Importantly, there is still time for Canadian governments to correct course. Large-scale LNG production in Canada has not yet begun, and construction has only advanced significantly for LNG Canada’s Phase 1. The Woodfibre LNG project has begun site preparation activities, but construction is not expected to begin in earnest until later in 2024. All other LNG export facilities are still awaiting various approvals—whether from provincial and federal governments or private investors. This delay allows Canadian governments to re-evaluate the economic and environmental risks of LNG expansion based on the most recent evidence. Beyond approvals, provincial and federal governments also have decisions to make regarding the financial support that they may offer these projects—including those already under construction. Governments and investors should reconsider whether spending billions on projects that jeopardize Canada’s economic and environmental security is an efficient use of public funds. The substantial risks associated with new LNG facilities suggest that LNG expansion in Canada is simply not viable from a long-term perspective.

A full list of references can be found here.

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This publication is a part of The Bottom Line policy brief series, which digs into the complex questions that will shape Canada's place in future energy markets.

You might also be interested in

Powering the Clean Energy Transition: Net-Zero electricity in Canada

This brief explains how a shift to clean power generation can offer affordable, reliable electricity, benefiting households and businesses alike.

New Report Highlights Economic and Environmental Costs of Canada’s LNG Expansion

New report explains how LNG expansion will not only hamper Canada’s progress toward its climate goals but also create challenges for the economy in the long term.

IISD Annual Report 2022–2023

At IISD, we’ve been working for more than three decades to create a world where people and the planet thrive. As the climate crisis unfolds on our doorsteps and irreversible tipping points loom, our team has been focused more than ever on impact.

State of the Sector: Critical energy transition minerals for India

This report presents a comprehensive strategy for securing a reliable supply of critical energy transition materials (CETMs) essential to India's clean energy and low-carbon technology initiatives.