Advisory Services, Technical Support, and Workshops

IISD's international lawyers and policy experts provide training courses, workshops, and a range of advisory services for developing economy officials—covering investment treaties, laws and contracts, negotiations, and dispute prevention and management.

IISD's pro bono advisory services, technical support, and in-person workshops help developing countries to navigate the wide range of legal and policy instruments governing international investment—enabling them to level the playing field in negotiations and disputes and making sure foreign direct investment truly supports sustainable development.

Our services on international investment law and policy include

- investment negotiation support and advice, including commentary on negotiating texts

- development of national and regional investment treaties or contract models

- development of national strategies and institutional frameworks for investment treaty negotiations and reforms

- investment treaty and contract implementation and design

- investment dispute prevention and management at the pre-litigation phase

- interactive workshops and practical training courses for negotiators and policy-makers on sustainable investment law and policy frameworks.

To learn more about IISD advisory services, please view our brochure in English and French, and please don't hesitate to reach out to our team at investmentlaw@iisd.org.

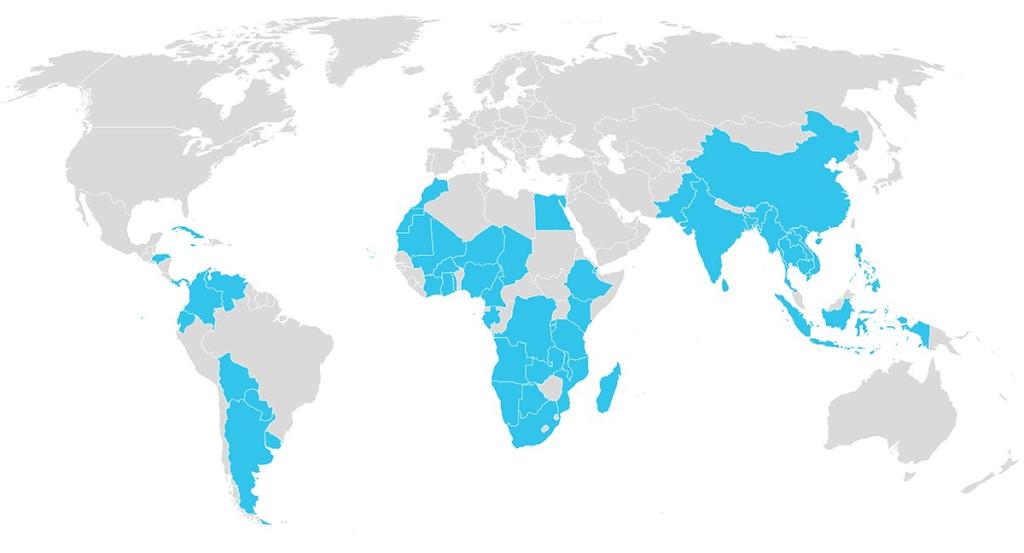

Our Beneficiaries to Date

Governments

A number of diverse countries have retained the advisory services of IISD’s legal team, including:

| Angola | Côte d'Ivoire | Mali | Sao Tomé and Principe |

| Argentina | Congo DRC | Marshall Islands | Senegal |

| Bangladesh | Ecuador | Mauritania | Seychelles |

| Benin | Egypt | Mongolia | Sierra Leone |

| Bolivia | Ethiopia | Morocco | South Africa |

| Bosnia and Herzegovina | Gabon | Mozambique | Sri Lanka |

| Botswana | Ghana | Myanmar | Tanzania |

| Burkina Faso | Honduras | Namibia | Thailand |

| Burundi | Hungary | Niger | Togo |

| Cambodia | India | Nigeria | Tunisia |

| Cameroon | Indonesia | Pakistan | Uganda |

| Cape Verde | Kenya | Paraguay | Vietnam |

| China | Lao PDR | Peru | Zambia |

| Colombia | Madagascar | Philippines | |

| Costa Rica | Malawi | Rwanda |

Regional Country Groupings, Institutions, and Processes

We have also provided advisory services to various regional country groupings, institutions, and processes, including:

| The African Continental Free Trade Agreement (AfCFTA) process | The Economic Community of Central African States (CEEAC/ECCAS) | Various African parliamentary groups | The Union of South American Nations (UNASUR) |

| The African Union (AU) | The Common Market for Eastern and Southern Africa (COMESA) | The Southern African Development Community (SADC) | |

| The Association of Southeast Asian Nations (ASEAN) | The East African Legislative Assembly (EALA) | The West African Economic and Monetary Union (UEMOA) | |

| The Caribbean Community (CARICOM) | The Economic Community of West African States (ECOWAS) | The United Nations Economic Commission for Africa (UNECA) |

List as of December 31, 2022.

Our core expert team is a diverse, cross-disciplinary team of lawyers, economists, and sectoral policy experts in agriculture, mining, and infrastructure. They are based in Africa, Asia, Europe, Latin America, and North America, and are also multilingual, providing support in Chinese, English, French, German, and Spanish, among other languages.

Project team

Nathalie Bernasconi-Osterwalder

Vice-President, Global Strategies and Managing Director, Europe

Suzy H. Nikièma

Director, Investment

Nyaguthii Maina

Associate

Josef Ostřanský

Policy Advisor

Florencia Sarmiento

Policy Analyst

Lukas Schaugg

International Law Analyst

Abas Kinda

Associate

Sarah Brewin

Associate, Advisor Agriculture and Investment

Latest

You might also be interested in

Investment Policy Forum

IISD's Investment Policy Forum is the world's only annual platform for investment negotiators from developing countries and a driving force for global sustainable investment reform.

Best Practices Policy Bulletins

IISD's Best Practices Series analyzes the evolving scope and nature of investment treaty negotiations, drawing on public treaty texts and model agreements from governments.

Ensuring Responsible and Sustainable Agricultural Practices by Assessing Agribusinesses’ Compliance With the CFS-RAI

This project incorporates a series of case studies focused on agriculture investments and their compliance with the Committee on World Food Security’s Principles for Responsible Investment in Agriculture and Food Systems (CFS-RAI) and the development of a new RAI scoring tool.

Advisory and Capacity Development Services on Legal and Policy Frameworks for Responsible Agriculture Investment

We advise and support governments in the drafting of model contracts in various sectors, including large-scale farmland investments, agricultural investment laws, legal frameworks for agricultural growth poles and zones, policies for attracting foreign direct investment in agriculture, contract farming templates and laws, and market opportunities for voluntary sustainability standards.