SAVi combines robust science, systems thinking and financial valuation. Its three features—simulation, valuation and customization—are inherently interlinked.

Simulation

SAVi combines the outputs of systems thinking and system dynamics simulation with project finance modelling.

System Dynamics Modelling

SAVi system dynamics modelling is conducted using Vensim, an industrial-strength software that can be used for simulating social, economic and environmental systems.

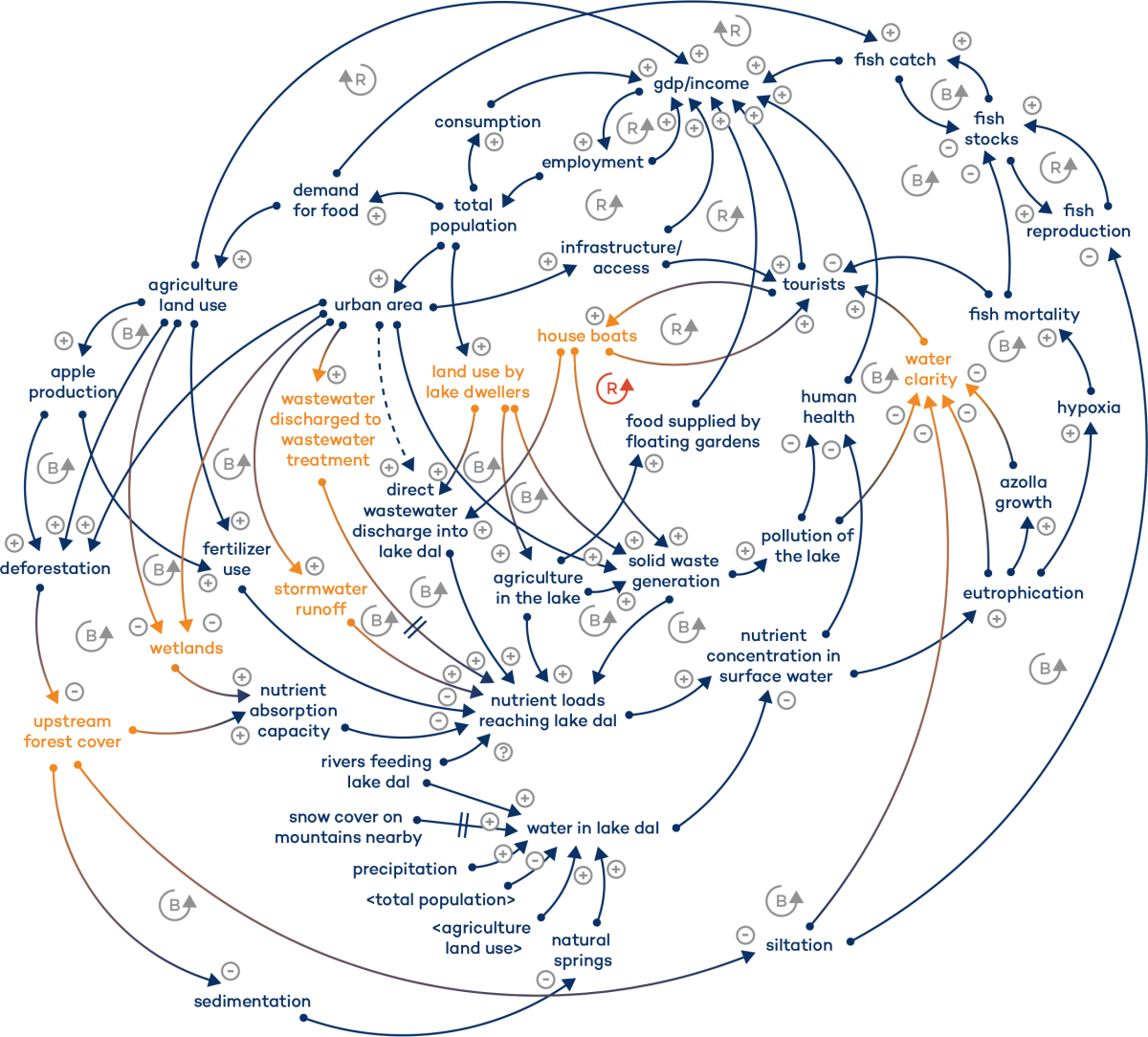

The model forecasts how the infrastructure project will affect and be affected by the environmental, social and economic dynamics of the “system” in which it is being planned, financed, built and operated. We develop systems maps or causal loop diagrams for a fast, accurate analysis of causes, effects and resulting model dynamics. Once this blueprint is complete, we create the mathematical model. We then simulate different risk scenarios to calculate how the asset performs under each of them. We can also change model inputs in real time, generating updated results within seconds.

Despite the variety of scenarios and outcomes that can be generated using the SAVi system dynamics models, simulation experts may consider this range to be relatively limited. Its complexity lies in the high number of cross-sectoral and cross-dimensional linkages.

Project finance modelling

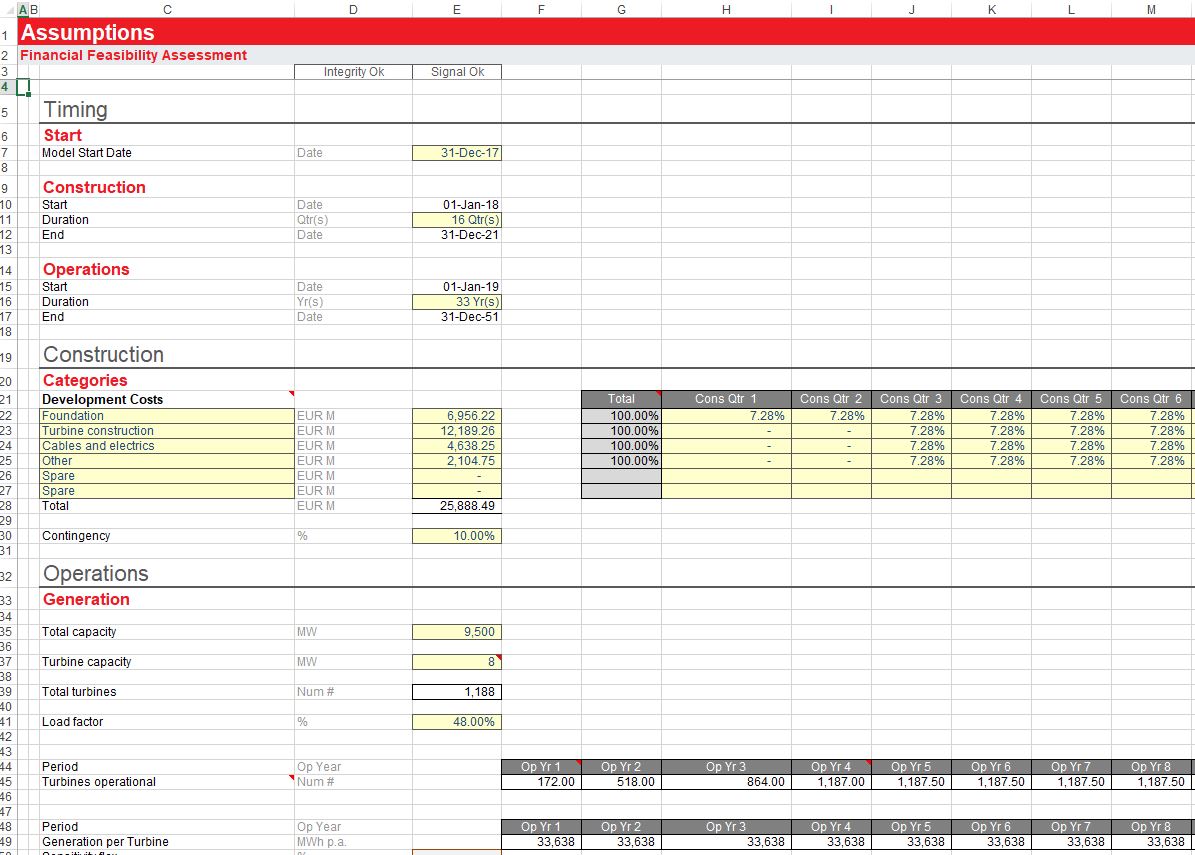

The SAVi project finance model is built in Microsoft Excel following Corality SMART, which is widely considered to be the industry’s best practice standard.

This model simulates how different risk scenarios affect the project’s financial viability across its life cycle, as well as how material externalities can affect future cash flows. We can therefore assess whether the cash flows generated by the project will be sufficient to service debts and generate an attractive risk-adjusted return for equity and debt investors. We generate results on the return on investment, gross margins, internal rates of return, net present values, debt service coverage ratios, loan life coverage ratios and other indicators as requested.

Our model is also well placed to stress test projects and assess how the expected returns change under certain risk scenarios, such as climate risks, operational risks, environmental risks, legal risks, revenue risks and more.

Engage with partner to understand and record asset or project characteristics.

Discuss material project risks. Determine risk scenarios. Identify externalities that are most material to asset owners and their stakeholders.

Create a causal loop diagram to determine model boundaries, data needs and emerging dynamics triggered by the project.

Create the custom SAVi simulation model. Obtain and verify project-specific data. Complement with internationally recognized data sets. Determine model assumptions and verify data and assumptions with partner.

Run the simulation. Validate the model and results following best practices in system dynamics and project finance modelling. Simulate alternative scenarios to test model sensitivity.

Analyze the results. When required, prepare an interpretation of model outcomes for multiple stakeholder perspectives.

Engage with partners on results. Run simulations in real time. Verify the interpretation of model outcomes. Assess how to present results to facilitate decision making.

Finalize results and reports. Support the partner with decision making and dissemination.