Beyond Fossil Fuels: Fiscal transition in BRICS

This report makes the case for preparing government budgets for the clean energy transition in BRICS (Brazil, Russia, India, China, South Africa).

Key Messages

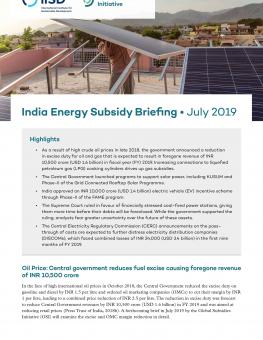

- As the clean energy transition advances, the BRICS governments need to start preparing their budgets for a fiscal transition out of revenues from fossil fuel production and consumption. The clean energy transition offers alternatives to fossil fuels and thus can lead to the decrease in revenues for the BRICS governments in two ways: through a drop in fossil fuel prices and, over the longer term, through the shrinkage of absolute amounts of fossil fuel production and consumption.

- In 2017, taxes and other revenues from fossil fuel production and consumption amounted to 23.6 per cent of general government revenue in Russia, 17.8 per cent in India, 6.8 per cent in both Brazil and South Africa, and 4.2 per cent in China. These revenues should be used strategically to help diversify BRICS economies away from fossil fuels and cover the social costs of transition, including for vulnerable groups of consumers, workers and communities currently depending on fossil fuels.

- The BRICS governments’ budgets are also being eroded by subsidies to fossil fuel production and consumption. Phasing out these subsidies will both increase government revenues and promote transition beyond fossil fuels.

For the first time, this report brings together official data on governments’ revenues and subsidies associated with fossil fuels in Brazil, Russia, India, China and South Africa (referred to collectively as BRICS). It offers initial recommendations on aligning BRICS's fiscal policies with a clean energy transition.

First, the cross-country analysis discusses external and domestic drivers of the clean energy transition and what they mean for BRICS as exporters and importers of different fuels. After an overview of the BRICS countries’ revenues and subsidies associated with fossil fuels, the report discusses avenues for fiscal transition beyond fossil fuels. The conclusion presents policy recommendations. The cross-country analysis also includes an Annex with data tables and a methodology and scope description.

In addition to the cross-country analysis, the report includes country briefs on Brazil, Russia, India, China and South Africa that highlight the role of fossil fuels in respective economies. These briefs present the aggregated data on both revenues and subsidies related to fossil fuels in each country. The country briefs can be downloaded separately.

This analysis has been prepared in partnership with the Leave it in the Ground Initiative.