Why Canada’s Energy Security Hinges on Renewables

The Bottom Line: Unpacking the future of Canada's oil & gas

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This policy is part three of The Bottom Line series, which digs into the complex questions that will shape Canada's place in future energy markets. (Download PDF)

Summary

- Energy security stems from energy availability and affordability.

- Canada’s energy system is dominated by oil, gas, and coal and is therefore susceptible to the geopolitics of global producers and unpredictable market forces.

- The cost of renewable energy has declined to the point where, in many markets, it is less expensive than gas or coal-fired electricity.

- Renewable energy prices do not fluctuate with global fuel markets, making them far less susceptible to volatility and price spikes.

- Canada is well positioned to manage high amounts of variable renewable energy without compromising reliability.

- Electrification of transportation and heating can further protect Canadians from exposure to volatile fossil fuel markets.

- Governments should prioritize investments in clean, flexible, and reliable electricity grids to support energy security.

Oil, gas, and coal have been the central pillar of the global energy system throughout the 20th century. And for decades, these fossil fuels have been closely associated with energy security.

The perception of energy security, however, is rapidly changing. Renewables form an increasing share of energy sectors worldwide as countries look to deliver on the Paris Agreement and mitigate the effects of climate change. Moreover, Russia’s invasion of Ukraine has demonstrated how relying on fossil fuels for power, heating, and transport has left many countries vulnerable or energy insecure.

The International Energy Agency (IEA) defines energy security as “the uninterrupted availability of energy sources at an affordable price” (IEA, 2019a). This definition hardly describes today’s global energy situation, with the cancellation of natural gas deliveries and skyrocketing prices for oil and gas products. These circumstances have cascading effects on electricity prices in countries like the United Kingdom that rely heavily on natural gas to produce electricity. In Europe, energy insecurity has been even further amplified since the Russian corporation Gazprom recently cut off gas supplies to several countries.

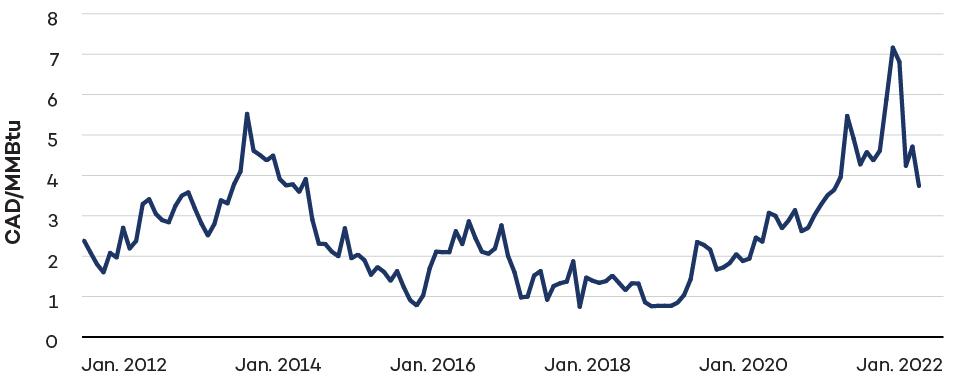

As a result, energy security has gained new urgency in Canada and worldwide. Recent events provide a stark reminder of the volatility and potential vulnerability of global fossil fuel markets and supply chains. Even in Canada, as one of the largest producers of oil and gas in the world, the price of fuels depends on global and regional market forces rather than government policy or market design. Thus, the average monthly price for gasoline in Canada hit a record high of CAD 2.07 per litre in May 2022 (Figure 1), and natural gas prices surged to a record CAD 7.54 per MMBtu in May 2022 (Figure 2).

Energy price increases of this magnitude are more than enough to strain Canadian household budgets. But on top of that, oil and gas prices have accelerated inflation more broadly as it has become more expensive to produce, transport, and store goods, including food and other basic commodities.

Figure 1. Monthly average prices of gasoline in Canada, 2006–2022 (CAD cents/litre)

Figure 2. Alberta Energy Company (AECO) natural gas prices in Canada (CAD/MMBtu)

Although the dynamics of rapidly transitioning energy systems remain uncertain, renewable energy technologies have the potential to improve energy security by providing uninterrupted and affordable energy in the immediate future.

Oil and Gas Markets Are Inherently Volatile—and Will Continue To Be

The inherent volatility of global fossil fuel markets became painfully evident in 1973 when the world saw its first oil crisis after World War II. The price of oil increased from USD 2.90 per barrel in October to USD 11.65 in January 1974, leading to a global recession. The oil crisis spurred governments worldwide to pursue other energy types, including renewable energy, nuclear, and hydropower, to ensure the security of supply. Most countries also increased efforts to extract fossil fuels domestically. Likewise, coal saw a resurgence, and governments turned to energy-efficiency policies such as car-free Sundays and other consumer-focused measures to curb demand.

Natural gas markets are more regional than oil markets. However, in the last decade, the regional gas markets have become more integrated due to better transportation opportunities and increased trade in liquified natural gas. Despite being more regional, due to market design, consumption patterns, and storage and transportability challenges, natural gas markets have arguably been more volatile than the market for crude oil.

The volatility of natural gas markets has been evident over the last year. Even before the Russian invasion of Ukraine, natural gas market instability was notable, with prices spiking significantly across all markets. In October 2021, record-high gas prices in Europe and Asia associated with the COVID-19 recovery were spilling over into the American market, driving 12-year high prices of USD 6.31 per million Btu. Likewise, implied volatility, a measure of the expected fluctuations of future gas prices, rose to an all-time high of 122.5% in early October. The war in Ukraine exacerbated these trends, leading to record-high prices in the North American market in 2022.

Faced with an energy crisis, the European Union (EU) and member states are doubling down on existing climate commitments and accelerating the transition away from natural gas. EU leaders are calling for more renewable energy to improve energy security: as EU Energy Commissioner Kadri Simson said, “The only long-term remedy against demand shocks and price volatility is a transition to a green energy system”. Similarly, the German Finance Minister has labelled renewable energy the “energy of freedom”, and the Danish government has decided to phase out natural gas completely by 2030 on energy security grounds.

“The only long-term remedy against demand shocks and price volatility is a transition to a green energy system”.

Renewable Energy Is More Affordable

In contrast to oil and gas, renewable energy can reliably deliver affordable energy. This is a unique and positive aspect of today’s energy crisis compared to historical crises: options for electrification and renewable-based electricity systems are both available and cost-effective.

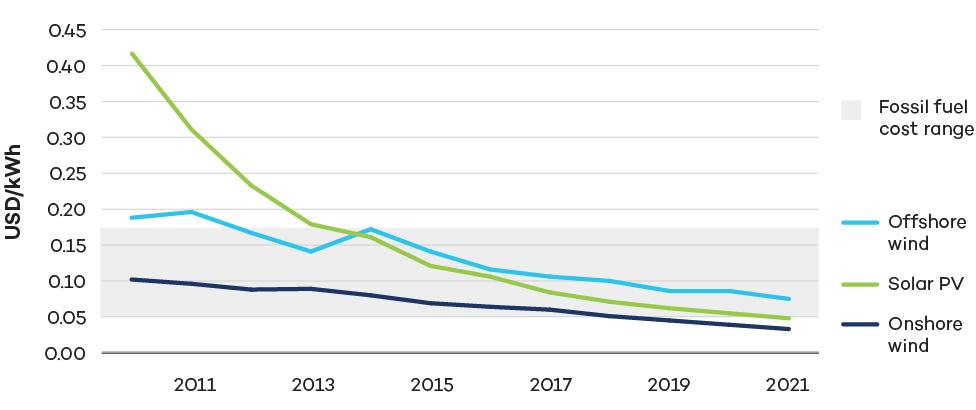

For new power capacity, wind and solar are now cheaper than any other source. According to Equinor, wind and solar were already cheaper than gas-based power in 2020. This means that renewable energy was already the cheaper option for new power before the recent natural gas price spikes. As illustrated in Figure 3, the cost of new renewable energy has dropped so dramatically that, for many countries, it is cheaper to install new solar or wind infrastructure than to keep operating existing fossil fuel-based power plants. This means that replacing fossil-based electricity generation with renewables would save money and reduce emissions. Wind and solar prices are expected to continue their downward trends as more countries increase deployment and learn how to best integrate these sources into the grid.

Figure 3. Levelized cost of electricity (LCOE) for newly commissioned utility-scale solar photovoltaic (PV) and onshore and offshore wind from 2010 to 2021 (USD/KWh)

The LCOE is a measure of the average net present cost of electricity generation for a generator over its lifetime. LCOE is frequently used to compare the price of different electricity generation options over an asset’s lifetime. Figure 3 shows significant price decreases for renewables over the past decade, with costs declining 88% and 68%, respectively, since 2010 for solar PV and onshore wind. The fossil fuel range illustrates that both solar PV and onshore wind prices are now lower than the cheapest fossil fuel-based alternative by 11% and 38%, respectively. IRENA’s LCOE numbers are based on a global weighted average.

One benefit of an electrified system powered by renewable energy is that it does not rely on input fuel to operate. Once built and connected to the grid, the cost of renewables does not fluctuate based on fuel prices; renewables can then operate at consistent, low costs, which, in turn, can lower electricity prices across the entire system. For instance, when the wind is blowing in Alberta, wholesale electricity prices in the province drop (Independent Power Producers Society of Alberta, 2022). Long-term price stability can also be locked-in through energy purchase agreements that guarantee the price of renewable resources decades into the future.

And finally, renewable energy is either installed (provincially/territorially) or imported regionally through transmission lines. With an electricity system based on renewables, governments can more directly ensure affordable and reliable energy through market design and policy.

Renewable Energy Is Reliable

To deliver on the uninterrupted availability side of the energy security equation, renewable power must remain reliable even as more variable energy sources, like wind and solar, are added to the system. For Canada and other countries to achieve high energy security through electrification, grid system operations must be able to support this.

Integrating variable resources on a large scale requires

- Strong transmission grids and interconnectors

- Regional electricity markets

- Flexible generation

- Specialized forecasting and planning tools.

Canada’s power sector is well placed to perform in all four categories. Canada has more than 160,000 km of transmission network lines, mainly running north to south across the U.S.-Canadian border. In terms of regional electricity connections, Canada has 37 connection lines to the United States and exports around 10% of its total electricity generation. More integration of provincial electricity grids is needed and there remain political, social, and institutional barriers to increasing interprovincial transmission infrastructure, however, interprovincial trade presents a technically feasible and cost-effective means to support increased renewables and improve the resilience of the grid.

Large hydroelectric resources can be operated with flexibility in order to ramp up and down to match changes in electricity supply or demand. Canada’s existing hydroelectricity capacity, which accounts for about 60% of the country’s electricity generation, provides significant flexibility to complement variable resources like wind and solar. In addition, all provinces and territories with a high proportion of fossil fuels on their electricity grids—which are thus prime candidates for a large scaling-up of renewables—are adjacent to provinces and territories with extensive hydroelectric resources that could support them. Additionally, provinces with existing large hydroelectric resources benefit greatly from purchasing low-cost renewable electricity from neighbouring regions, and shifting the use of more expensive hydro to when it’s needed.

Storage technologies are another means to improve the flexibility of the grid. Like renewables, the costs of utility-scale lithium-ion batteries are falling rapidly and are projected to continue to decrease, in part due to innovation in transportation applications.

Forecasting is also well advanced, with regions using 12-hour power forecasts that are updated every 10 minutes. As wind and solar capacity in the power system increases, forecasting will improve based on the analysis of historical data from installed sources.

The integration challenge has already been solved in European countries with high shares of variable renewable resources. In Denmark, the security of supply is 99.997% (the highest in Europe), with 50% of all power coming from wind. Moreover, forecasting and the reliability of wind power are so advanced that it is part of the capacity market for manual reserves, which means that variable renewable energy is considered as reliable as thermal power plants based on biomass or coal.

Renewables Can Provide Energy Security to Canadians

In Canada, gas-generated power accounts for 11% of total electricity production. Refined petroleum products and natural gas use account for 76% of total end-user demand across the country, including for transport and heating. Therefore, most of the energy that Canadians use is priced based on markets that are outside of Canadian control. As the current energy crisis shows, global price mechanisms for fossil fuels provide no shelter for Canadian consumers, even though Canada is a major oil and gas producer. Nevertheless, Canada is well placed to bolster its energy security by supporting electrification and renewable energy.

Clean electricity grids are well within reach across the country. Canada is already a global leader in the power sector, with 82% of its electricity coming from non-emitting sources, mainly hydropower. Legacy hydroelectric development has been bolstered by coal phase-outs, implemented first by Ontario and Alberta and followed by a federal regulation ensuring a nationwide phase-out by 2030. More recently, the federal government has committed to a non-emitting electricity grid by 2035 and developing clean electricity regulations to meet that end. Detailed modelling has shown how Canada can meet its 2035 target, support increased electrification, and provide reliable, affordable electricity across the country by prioritizing wind, solar, electricity storage, and additional interprovincial transmission. This scenario is modelled with no new nuclear or natural gas generation.

Expanding renewables is also a cost-effective option. Electricity prices across the country demonstrate that provinces and territories with high shares of renewable energy have been able to keep power prices low with renewable electricity production. Households in fossil fuel-reliant provinces such as Saskatchewan pay 60% more for their power than households in Quebec and 45% more than households in Manitoba. Although the cost differential is related to legacy hydroelectric development, the falling costs of solar, wind, and battery technology mean that these sources provide the lowest cost options for supplementing existing hydroelectricity or replacing coal and gas power generation.

Information from the Alberta Electric System Operator confirms that wind and solar are already the cheaper options for new power than gas (normally the cheapest fossil fuel-based alternative). This shift is also evident when looking at actual power sector development in Alberta in recent years. In its deregulated and competitive market, Alberta added a remarkable 1.6 GW from wind and solar between 2019 and 2021, resulting in wind and solar accounting for 17% of total capacity in 2021. At the same time, the province has phased out coal faster than expected.

Modelling in Alberta, New Brunswick, and Nova Scotia has also shown that clean energy portfolios, including wind, solar, battery storage, demand flexibility, and energy efficiency, can provide the same grid services as natural gas generation at a lower cost.

As noted above, more flexible electricity grids will be needed to support renewables. This flexibility will include more integrated provincial and territorial grids that maximize renewable energy sources across the country. Currently, Canadian provinces are better connected to the United States than to each other. Provinces and territories need to improve connectivity so that Canada can benefit from their different strengths—from plentiful hydropower in some provinces and territories to the enormous potential for wind and solar in others. Additional investments and regulatory reforms are necessary to ensure adequate storage and “smarter” grids that support improved forecasting of supply and demand and that fully enable demand management.

Reducing Demand for Fossil Fuels Increases Energy Security

While renewables and storage technologies can eliminate fossil fuels from the electricity grid, electrifying end uses and reducing demand through energy efficiency will limit Canadians’ direct exposure to fluctuating fossil fuel prices. At the household level, electricity currently accounts for 23% of energy use. However, that is predicted to grow to 96% in 2050 if Canada achieves its net-zero target.

While this transition is already underway, accelerating the phase-out of fossil fuels in household consumption will improve energy security, in part because sectors such as personal transport and heating, where demand for fossil fuels is high, have readily available, cost-competitive alternatives.

The federal government’s target of no new combustion engine vehicles as of 2035 is a policy step that will not only help Canada build a cleaner future but also help to considerably reduce its dependency on oil and gas. Canada has more than 25 million light-duty vehicles on the road, and to reach the 2035 target, the government is aiming for 60% of new sales to be zero-emission vehicles by 2030. However, it has been noted that the market for electric vehicles is now established to the point where market dynamics are replacing government policy as the key driver for adoption.

Other demand-side policies could include efforts in Canada’s building sector, where gas plays a key role. About a quarter of Canada’s final energy consumption comes from buildings, with 65% going to heating and cooling (IEA, 2019a). Choosing high-efficiency electric heat pumps for heating and cooling and investing in deep energy retrofits will help reduce Canadians’ exposure to volatile natural gas prices while reducing emissions and improving the comfort of homes.

The electrification of buildings and transport will create additional demand for electricity requiring 2.2 to 3.4 times more electricity capacity in 2050. However, detailed modelling shows how this increased demand can be reliably met with wind, solar, energy storage, and interprovincial transmission.

Renewables and Electrification Are Key to Energy Security

Canada is a leading producer of oil and gas. However, systems that rely on fossil fuels to operate will continue, throughout their lifetime, to be subject to volatile market forces, supply chain disruptions, and geopolitics. This volatility is a risk to energy security because it means that Canadian governments, both provincial and federal, have little recourse to ensure that affordable and reliable energy supplies are available.

Fortunately, the transition to an electrified system based on renewables has already begun, and cost-competitive, clean alternatives to oil, gas, and coal are available. The costs of wind, solar, and battery storage technologies are rapidly declining, and experience shows how grids can support significant amounts of variable renewables while maintaining reliability. At the same time, the electrification of transport, heating, and cooling are poised for major gains.

Limiting the effects of climate change has been a driver for electrification and the deployment of renewables. However, energy security provides a rationale to accelerate the transition. Although the amount of electricity that households use will increase, overall energy costs are projected to decrease. Since renewables do not require input fuels, their operational costs are both low and predictable. Completing the transition will require planning and investment. In particular, governments need to ensure that regulatory reform, market design, and investment in grid infrastructure enhance the flexibility and resilience of electricity grids. In addition, it will be necessary to ensure that access to clean, affordable energy services—including energy efficiency options—is available to Canadians in all regions and income levels.

Nevertheless, renewables and electrification are the best options to increase Canada’s energy security, particularly the long-term affordability of supply. For the first time in history, governments have the tools to address the systemic problems with oil and gas that an energy crisis has once again laid bare—Canada now needs all hands on deck to seize the opportunity and reap the benefits.

A full list of references can be found here.

Re-Energizing Canada is a multi-year IISD research project envisioning Canada's future beyond oil and gas. This publication is part three of The Bottom Line policy brief series, which digs into the complex questions that will shape Canada's place in future energy markets.

Additional downloads

You might also be interested in

Why Canada Needs to Plan for a Steep Decline in Global Oil Demand

This analysis demonstrates that Canada can expect global oil demand to permanently decline in the very near term, as electric vehicle uptake and other societal changes pick up speed.

Why Canadian Liquefied Natural Gas Is Not the Answer for the European Union’s Short-Term Energy Needs

This investigation shows that Canadian LNG infrastructure would come too late to address Europe’s energy security needs and offer little benefit to Canada’s economy.

Powering the Clean Energy Transition: Net-Zero electricity in Canada

This brief explains how a shift to clean power generation can offer affordable, reliable electricity, benefiting households and businesses alike.

Why Liquefied Natural Gas Expansion in Canada Is Not Worth the Risk

An analysis of the economic and environmental risks of liquified natural gas expansion in Canada.