Feeling Insecure? Walking the tightrope of India’s LPG subsidies, energy access and energy security

In 2015, nearly 780 million people, or more than 60 per cent of the Indian population, did not have access to clean cooking. Like many countries, the Government of India has attempted to address this by subsidizing liquefied petroleum gas (LPG).

Subsidies have promoted LPG among the poor—but continue to be used by the large middle-class population too, thereby increasing overall LPG consumption and subsidy costs. As consumption grows, India relies more and more on imported LPG, which poses important questions about energy security.

What are the energy security risks of a growing reliance on LPG? What role do subsidies play? And what can countries like India do to mitigate energy security concerns without compromising energy access?

India’s LPG subsidies[1]

For many years, the Government of India has provided LPG consumption subsidies for all households, most recently through the PAHAL policy, where a cash subsidy is directly transferred to the bank account of consumers.

In May 2016, driven by SDG 7 on clean energy access, the government decided to offer additional subsidies to help poor consumers afford the up-front costs of switching to LPG, through the Pradhan Mantri Ujjwala Yojna (PMUY) scheme. From May 2016 to April 2018, 36 million households received a subsidized LPG connection. PMUY has now been expanded to target 80 million households.

Concerned by the high cost of LPG subsidies, the government encouraged richer households to voluntarily give up the consumption subsidy via the Give it Up campaign. It claims that about 11 million households (approximately 6% of consumers) gave up LPG. The long-term impacts, however, may be smaller than this: households can reclaim the LPG subsidy after one year and around 100,000 have reclaimed the subsidy as of April 2017, due to increasing LPG prices.

In early 2017, the government also mandatorily unsubscribed taxpayers earning more than INR 1 million (USD 15,000) per year from consumer subsidies. However, as the number of people paying tax in India is very low (estimated to be between 1.5 per cent and 3 per cent of the total population), this had a limited impact.

All together, these measures have marginally improved the targeting performance of consumption subsidies, while increasing the LPG consumer base to around 170 million households.

What are the energy security risks of India’s growing LPG consumption?

-

Growing LPG imports and impacts on the balance of trade

There is an increasing gap between India’s domestic production and consumption of LPG. In June 2018, it was about 0.8 million tonnes—which must be bridged by LPG imports.

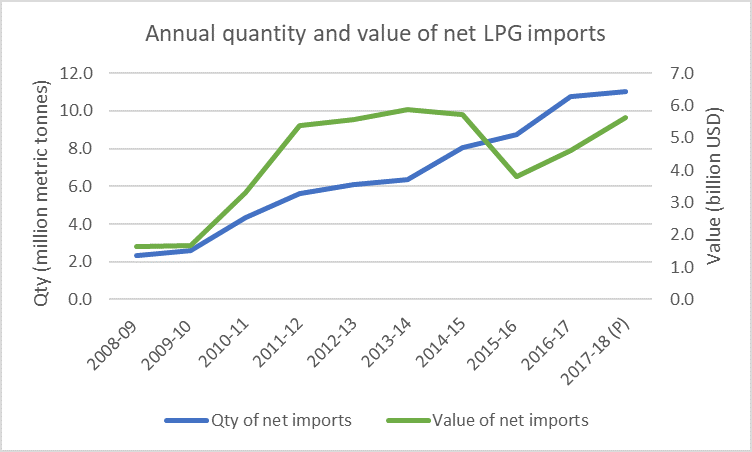

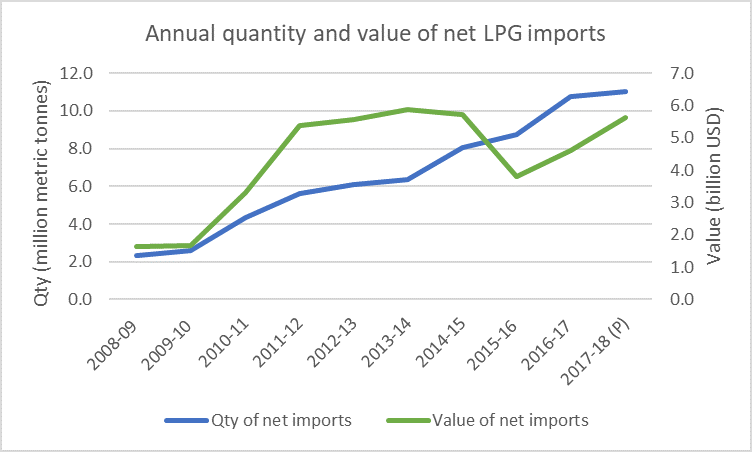

As illustrated in the figure below, the volume of imports has grown five times from 2008/09 to 2017/18. In late 2017, India became the second largest LPG importer, overtaking Japan. The value of LPG-related foreign exchange outflow is estimated to reach USD 5.6 billion in 2017/18 (provisional numbers), contributing to around 6.5 per cent of the total trade deficit of USD 87 billion.

A high trade deficit is a drain on foreign exchange and leads to current account deficits. The country needs to borrow more to fund its infrastructure and social spending, thereby incurring international debt. A high trade deficit also builds pressure to devalue the local currency. While a trade deficit may be essential to driving economic growth, especially in emerging economies like India, unnecessary consumption of imported products should be avoided: these resources could be better invested in the domestic economy.

LPG price volatility brings in additional risk. The annual average import price of LPG for India was lowest at USD 430 per tonne in 2016/17 and highest at USD 964 per tonne in 2011/12. This variation—more than 100 per cent—directly affects the LPG import bill, with consequences for the outflow of resources, and makes it hard to control government expenditure on subsidies. The depreciating rupee may add further problems to controlling the outflow of foreign exchange.

Currently, LPG prices are again on an upward trend, having reached around USD 514 per tonne in 2017/18. In Delhi, the subsidized price of an LPG cylinder has increased from INR 524 (USD 7.6) in August 2017 to an all-time high of INR 789.50 (USD 11.5) in August 2018 for a 14.2 kg cylinder. This has created widespread agitation for lower prices, pressuring the government to further increase the subsidy.

-

Increasing supply insecurity

India imports most of its LPG from Qatar, Saudi Arabia, Iran and United Arab Emirates in the Middle East, a region with high geopolitical risks. A U.S.–Gulf Cooperation Council-led diplomatic and economic blockade of Qatar in 2017 is a reminder of the risk of a sudden disruption in supply, which can cause price shocks and shortages. The re-imposing of U.S.-led sanctions on Iran may also be the beginning of the end of supply of Iranian LPG, as the United States is pressurizing India to cut imports.

-

Additional infrastructure requirements

Increasing imports of LPG will require large investments in ships, receiving and storage terminals, and refilling and bottling plants. Already in the planning stages are a 1.5-million-tonne-per-year terminal at Haldia (Aegis Logistics), a 3.5-million-tonne-per-year terminal at Mundra (Adani) and a 1.5-million-tonne-per-year terminal (BPCL) and LPG receiving terminals at Kochi and Paradip (IOC). Expansion of domestic potential refineries at Vadodara and Panipat (IOC), Visakhapatnam and Barmer (HPCL), and at Jamnagar (Reliance) is also in the cards. This infrastructure expansion requires billions of dollars of public and private investments. Further, the government will need to continue efforts to promote a network of distributors for last-mile connectivity of LPG to remote areas.

What measures can be taken to mitigate risks?

Improving the targeting of LPG subsidies is an important strategy. Aggregate LPG subsidies have almost been halved between 2013/14 and 2017/18. This has been mainly due to lower global oil prices. The axing of high-income consumers from the subsidy scheme and the reduction of leakages have also played a positive role.

The government has also tried to reduce the per-unit consumption subsidy for LPG. In July 2017, the petroleum minister announced that the subsidy would be reduced by INR 4 per month until it was completely eliminated, or until March 2018, whichever came first. However, this approach led to concerns that it would negatively affect energy access. In December 2017, it was ultimately suspended. The subsidy component on each cylinder has once again started growing with rising international LPG prices.

Supply risks can be partly mitigated by diversifying the sources of supply. Although some countries such as the United States (which commenced LPG shipments to India in late 2017) and Australia have the potential to supply LPG, the higher cost of transportation to the Indian market will increase the average price of imports.

Finally, impacts can be reduced by promoting a diverse range of clean cooking fuels. Given the limited options for low-income consumers, this may need to include a focus on shifting higher-income households to alternative cooking technologies. The Draft National Energy Policy acknowledges that solutions such as electricity, induction stoves and biogas have not seriously been considered as cooking fuel options—and that a joint, strategic approach to a National Mission on Clean Cooking is sorely needed.

Conclusion

Like other countries, progress on clean cooking in India has straggled for many years. India’s recent efforts to support LPG consumption among the poor has dramatically increased the number of consumers—but it also brings into perspective important questions about subsidy efficiency and the security of supply. Energy access is a priority, but if solutions are going to be sustained they must be insulated against fiscal pressure, price volatility and supply risks, or poor consumers will be the first to suffer.

Simultaneously balancing concerns about subsidies, energy access and energy security—in a period of rising prices and falling affordability—will indeed be a tightrope walk for the Government of India in the months and years to come.

Kapil Narula is a Senior Researcher at the Institute for Environmental Sciences (ISE), University of Geneva. He is a former Indian naval officer who is trained as an electrical engineer, development economist, and an energy and sustainability professional. Kapil’s PhD thesis was titled Sustainable Energy Security for India and quantitively assessed India’s energy system while focusing on policy measures for its transition. His seventh book, titled The Maritime Dimension of Sustainable Energy Security was recently published by Springer.

Christopher Beaton is a Senior Policy Advisor with IISD’s Global Subsidies Initiative (GSI) and the lead of its program of work in India. His recent projects include assessments of energy subsidies for fossil fuels and renewable energy in India and the exploration of how fossil fuel subsidies can be shifted to support more sustainable energy systems.

[1] For more information about India’s energy subsidies, see the IISD report India’s Energy Transition: Mapping Subsidies to Fossil Fuels and Clean Energy in India

[2] Data for this table is drawn from Petroleum Planning & Analysis Cell’s (PPAC) Data for Crude and Products – Quantity and Data for Crude and Products – Value in Dollars.

[3] Subsidy data in this figure is reported directly from the Petroleum Planning and Analysis Cell (PPAC) data on Under-Recoveries to Oil Marketing Companies (OMCs) on Sale of Sensitive Petroleum Products and Fiscal Subsidy on Public Distribution System (PDS) Kerosene and Domestic LPG.