Removing Fuel Subsidies: Clearing the Road to Sustainable Development

Fuel prices, fuel taxation and subsidies for petrol and diesel fuel rank high on the world's political agenda, particularly after the spectacular increases in world market prices for crude oil (up to USD 75 a barrel in August 2006) and the subsequent slide in price to around USD 54 a barrel in January 2007. In this age of high and volatile fuels prices, how countries tax fuels and regulate prices has important implications for economic growth and environmental sustainability.

Despite the fact that taxing fuels provides a vital source of government revenue, a number of developing countries keep fuel taxes low, and in some cases even cut prices with subsidies. By forgoing fuel-tax revenues, national budgets for both the maintenance and extensions of the road infrastructure are often insufficient. Indeed, in many developing countries existing road networks have been left to decay - despite their crucial role for the development of a country.

In contrast with GTZ's last global survey of fuel prices in November 2004 (when the price of crude oil was around USD 43 per barrel), the most recent survey points to two promising trends: many countries have massively reduced their fuel subsidies, particularly heavily populated countries such as Indonesia, Nigeria and China. Meanwhile, in India, the Eastern European EU countries, and Russia, there is a growing trend towards increased levels of fuel taxation.

Indeed, the dramatic spike in the price of oil in the summer of 2006 has had a salutary effect worldwide. Countries which had previously followed a low fuel-price-policy (such as China, Russia and Viet Nam) have allowed prices to rise. Wide-spread fears of economic collapse due to increased fuel prices have proved groundless. Instead, a country like India, with prices of USD 0.75 per litre (USD 2.89 per gallon), is showing remarkably strong economic growth.

However, there are still several countries which regard low prices as an element in poverty reduction or economic promotion. These include Venezuela, with prices of USD 0.01 per litre for diesel and USD 0.03 for premium gasoline (USD 0.04 and USD 0.12 per gallon respectively); Iran with prices of USD 0.03 per litre for diesel and USD 0.09 for premium gasoline (USD 0.12 and USD 0.36 per gallon); Egypt (USD 0.12 per litre, or USD 0.46 per gallon, for diesel); and Yemen, where despite sharp price increases, the government still subsidises prices of USD 0.28 per litre (USD 1.08 per gallon) for diesel.

What does "subsidising" fuel mean in the transport sector?

It is not always a simple matter to determine whether fuel prices are actually subsidised in a specific country. For the GTZ surveys we take a simplified approach: fuels are considered subsidised if the actual price is below a (hypothetical) reference price ("benchmark"). Ideally, this benchmark price would be based on the price set by the private sector in competitive markets, excluding tax. However, as competitive benchmark prices are difficult to observe precisely in every market, for practical reasons and to allow worldwide application, we deem prices to be subsidised if they are below the average US prices, less road taxes averaging USD 0.10 per litre (i.e., those charged in the USA).

On 15 November 2006 (when the spot price for Brent crude was approximately USD 60 per barrel), the benchmark prices were:

- Fuel Pump Price

- Diesel USD 0.59 per litre

- Super (premium gasoline) USD 0.53 per litre

Following this definition, countries with fuel subsidisation include not only Egypt and Yemen, which have no significant petroleum production, but also Syria, Cuba, North Korea, Turkmenistan and Myanmar. Oil producing countries are also considered to be subsidizing fuel if their prices are below the benchmark prices. Although the (low) production prices are often described as "unsubsidised" because local costs of production are low, we would counter that this fuel could have been sold at a higher price on the world market and thus represents missed sales opportunities.

Exemplary pilot countries for taxation and reduction of subsidies

Certain countries can serve as important models for a region. In the past year, Morocco, Tunisia and Ghana -- with after-tax prices of, respectively, USD 1.22, USD 0.83 and USD 0.86 per litre for premium gasoline - have reached "reasonable" fuel price levels. Indonesia, with gasoline priced at USD 0.57 per litre, has successfully turned its back on a long history of price subsidies.

This paper uses the (simplified) assumption that all fuel prices above the benchmark price for unsubsidised fuel indicate taxation. As a rough estimate, it can be assumed that the difference between the actual pump price and the benchmark price approximately represents the amount of the tax. This tax can take many different forms (including VAT), but the common feature is administration by the state.

We believe that fuel taxation should be based on three fundamental principles, which together prohibit any form of fuel subsidy in the transport sector:

- Fuel taxation should be based on the "users pay" principle, i.e. through the fuel tax road users should be charged the full cost of providing a country's road network.

- Transport should contribute to state finances. We also maintain that fuel is a normal good just as any other good and should be subject to full VAT. This VAT should be charged in addition to the fuel tax, and possibly even additional or sumptuary taxation can be levied. In many developing countries tax revenue from the transport sector could make a major contribution towards financing core state functions, such as health services, education and security, particularly if other forms of taxation are too difficult to administer.

- Prices in transport always have a guiding function. Taxation should thus be designed to avoid undesired price distortions; for example, between different forms of transport such as private transport, local public transport, rail transport etc.

In the case of uncongested infrastructure, some transport economists suggest that it is more efficient to pay for maintenance and renewal costs from general tax revenues in order not to suppress the use of the facility. There is, however, a strong trade-off between efficiency and cost coverage. In the absence of an efficient income tax system the most practical way to generate sufficient revenues to build and finance transport infrastructure is to incorporate those charges into user fees. Our guiding principles reflect this fact and stress the importance of cost coverage.

Developing sustainability strategies in the transport sector

Eliminating subsidies and imposing taxes that generate revenue to finance the transport sector, as well as other sectors such as health and education, is only the first step. As in Europe, additional taxation of fuel can be used to spur improvements in fuel efficiency, encourage the use of alternative and cleaner fuels, and promote less polluting forms of transport.

Indeed, fuel taxation can be designed so that the price signals help promote positive side effects. For example, introducing a higher tax rate on high-sulphur fuels can result in increased sales of low-sulphur fuels (which are less heavily taxed). Moreover, fuel tax revenue can be used to cross-subsidize local public transport in cities (e.g. in the form of subsidies for municipal bus routes or support for regional rail transport).

When looking at road sector finance only, the actual amount of revenue needed depends on the size and quality of the road network, the volume of traffic, and whether the tax is to fund only road maintenance or road construction generally.

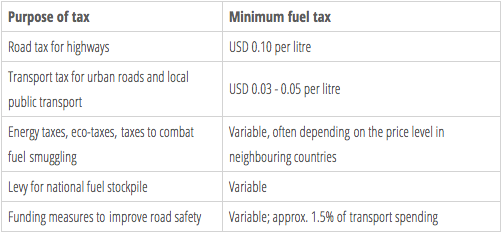

Based on GTZ's worldwide experience, the following minimum guidelines can be regarded as a general guide for tax levels:

The above goals can be summarised in a step-by-step procedure for implementing progressively higher fuel taxes.

Step 1: Cut subsidies that bring pump fuel prices below crude oil prices. This is the challenge currently facing countries such as Egypt and Yemen.

Step 2: Increase prices up to the price for unsubsidised fuel. (The benchmark could be the average US pump price less USD 0.10 per litre), then let the price vary in line with changes in world prices.

Step 3: Add a tax sufficient to cover the costs of maintaining the road infrastructure. In the United States, such taxes average USD 0.10 per litre. Fuel prices should also be subject to the regular value-added tax (VAT), revenues from which go into the general state budget.

Step 4: If, general taxes are not reliable sources for funding road construction and cross-subsidizing public transport, raise fuel taxes to the level that would be sufficient to finance these activities, as well as road maintenance. In Europe, such taxation levels are reflected in the legislated minimum European fuel prices, which are subject through EU harmonisation to minimum tax rates of EUR 0.287 (USD 0.37) per litre for unleaded petrol and EUR 0.245 (USD 0.31) per litre for diesel.

Step 5: This entails taxing fuel at levels currently seen in European countries such as Germany and the UK, which in addition to covering the full direct costs of the transport sector generate revenue for other sectors, such as education, health and security. Fuel tax rates in Germany, for example, are EUR 0.65 (USD 0.73) per litre of petrol and EUR 0.47 (USD 0.53) per litre of diesel. Increased tax rates apply to high-sulphur fuels and leaded petrol.

If the heavily populated and economically dynamic states of Asia were to raise their fuel prices to the European level, this would provide a major incentive to achieve greater efficiency in the transport sector, since high fuel prices act as an incentive to conserve fuel. This would not only save valuable oil resources (and foreign currency for oil-importing countries) but would also help cut hazardous emissions. And it would be a major contribution to cut CO2 emissions in the transport sector. But for developing countries, the major advantage is that fuel taxation can tap a broad base of revenues, providing a significant source of financing for both their roads and the general budget.

Editor's note: The Deutsche Gesellschaft für Technische Zusammenarbeit GmbH (GTZ), on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ), has been regularly surveying fuel prices at the pump in some 170 countries since 1991. These data, which are collected by GTZ's offices around the world, permit conclusions to be drawn on the subsidising or taxation of fuel worldwide and are available on the Internet at www.gtz.de/fuelprices. They are also used in the World Bank's annual World Development Indicators report. All prices quoted in this article refer to current fuel prices as of 15 November 2006, when the average price for a barrel of Brent crude oil stood at USD 60.21.