July Edition | Carbon Minefields Oil and Gas Exploration Monitor

This newsletter provides monthly updates on oil and gas expansion globally. It monitors the climate impact of countries issuing exploration licences and companies sinking capital into exploration activities.

This newsletter provides monthly updates on oil and gas expansion globally, reporting on every new oil and gas exploration licence awarded. It also tracks the climate impact of these licences, translating them into total embodied emissions—that is, the amount of carbon dioxide (CO2) released into the atmosphere if the licensed oil and gas is extracted and burned. Finally, the monitoring of companies’ spending to explore and develop new oil and gas fields provides additional insights into the industry’s expansion activities. Certain data is segmented according to countries’ capacity to transition away from oil and gas.

Halting new fossil fuel projects is a key step in limiting global warming to 1.5°C and transitioning away from fossil fuels, as agreed by 198 countries at COP 28. Research by Green et al. (2024) in Science shows there is more than enough oil and gas in existing fields to meet Paris-aligned energy demand. Accordingly, the Carbon Minefields newsletter monitors efforts to expand oil and gas production beyond already operating fields—flagging misalignment with the Paris Agreement target.

The data below is collected by experts at the International Institute for Sustainable Development (IISD); we use AI and programming tools to extract and analyze data from Rystad Energy (2024) before reviewing all content for accuracy and clarity.

Monthly Update

New Exploration Licences Awarded

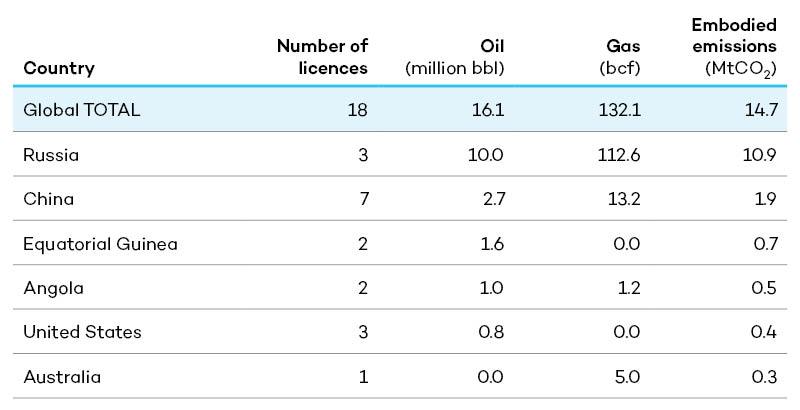

In the past month, 18 oil and gas exploration licences were granted in six different countries. The total carbon emissions projected to be produced from burning the reserves encompassed in all the licences across the six countries amounted to 14.7 million tonnes of CO2. While Russia awarded only three licences, the combustion of their estimated oil and gas reserves would emit 10.9 MtCO2, by far the most of any country last month. China awarded the most licences, which included 2.7 million barrels of oil and 13.2 billion cubic feet of gas.

Table 1. Emissions embodied in newly awarded licences in June 2024

Oil and Gas Companies' Exploration Activities

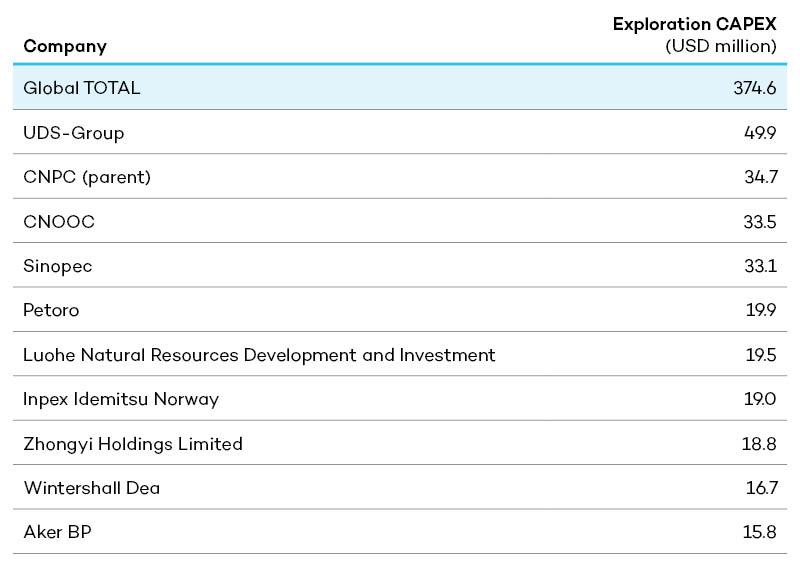

Last month, the companies that invested the most in oil and gas exploration, a total of USD 118.1 million, were UDS-Group, China National Petroleum Corporation—CNPC (parent), and China National Offshore Oil Corporation (CNOOC). The exploration licences with the highest embodied emissions were acquired by UDS-Group, CNPC (parent), and Chevron, mostly from Russia, China, and Equatorial Guinea. The global exploration capital expenditure (CAPEX) for projects awarded or discovered in the same period amounted to USD 374.6 million.

Table 2. List of top 10 companies’ exploration CAPEX in June 2024, ranked by spending

Rolling Annual Update

Licences Awarded

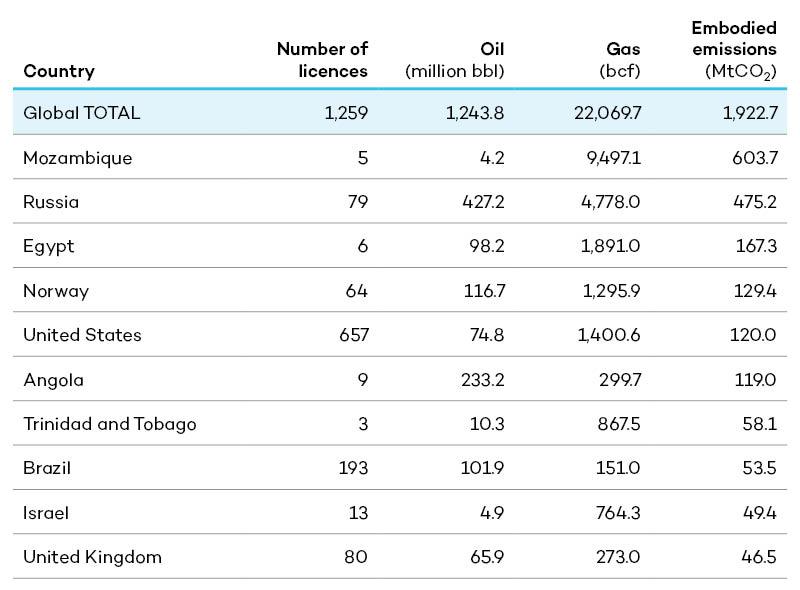

A total of 1,922.7 MtCO2 would result from burning the oil and gas reserves that were licensed over the last 12 months. May 2024 saw the largest amounts of oil and gas volumes awarded, representing more than 600 MtCO2. However, in December 2023, a higher number of smaller licences were awarded, with a total of 673 granted in this month. The countries awarding the licences with the highest estimated volume of embodied emissions are typically those with low capacity to transition away from oil and gas production and a high dependence on these fuels. This category includes Angola, Republic of Congo, Oman, Russia, and Timor-Leste. The country that awarded the largest volumes of oil and gas over the past 12 months was Mozambique, with just five new licences in May 2024. Mozambique does not yet get sufficient revenues to classify as highly dependent but is betting on the sector for its economic development.

Note: The embodied carbon emissions from newly awarded licences are presented based on four country groups based on the Civil Society Equity Review (2023) categorization. Countries are grouped based on two main axes: 1) their capacity to transition and 2) their dependence on fossil fuels, which provides a rationale to determine how fast they should phase out their domestic production. These indicators are measured based on countries' ability to deal with the costs and disruptions of climate change and historical emissions, as well as an assessment of how dependent a country’s socio-economic welfare is on extraction.

Table 3. Top 10 countries with the highest emissions embodied in awarded oil and gas licences in the last 12 months

Exploration CAPEX

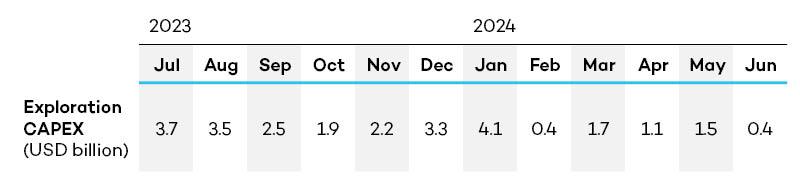

In the last 12 months, total oil and gas exploration CAPEX in newly awarded or discovered fields reached an estimated USD 26.2 billion. January 2024 was the peak investment period and monthly spending averaged about USD 2.2 billion. Rystad data shows that Equinor, Shell, and BP were the top investors, collectively allocating USD 4.8 billion toward exploration over that period.*

Table 4. Global exploration CAPEX of oil and gas companies over the last 12 months, in billion USD

Outlook

Ongoing and Upcoming Licencing Rounds

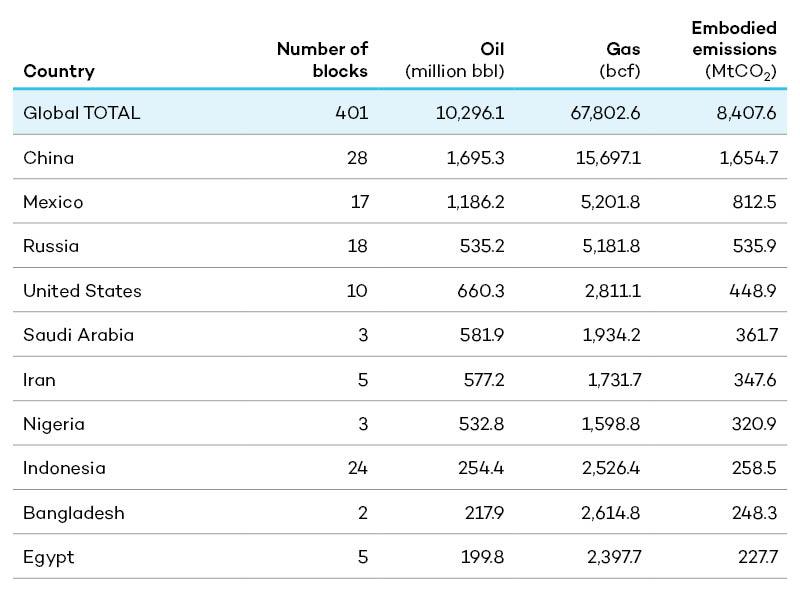

As of last month, there were 22 blocks open for bidding or under evaluation for oil and gas exploration. Looking ahead, upcoming licensing rounds are expected to offer a total of 401 blocks for exploration in 2024. The estimated global emissions resulting from burning the fuel reserves in these upcoming rounds is a staggering 8,407.6 MtCO2. Among these rounds, China leads with the highest number of oil and gas reserves within these blocks that have the potential to generate 1,654.7 MtCO2 if exploited.

Table 5. Estimated embodied emissions in upcoming licensing rounds in 2024: Top 10 countries

Global Exploration Trends

If all the estimated oil and gas volumes embodied in licences already awarded turned into producing fields, the world would extract more than twice the amount of oil and gas consistent with any credible 1.5°C scenarios by 2040. The 'production gap' between forecasted production pathways and Paris-aligned scenarios is not just widening, but widening at the highest rate since 2015. The oil and gas volume in newly awarded exploration licences is expected to rebound to pre-2020 levels this year. This is largely due to a resurgence of exploration activities in rich countries with low economic dependence on the sector, which awarded an all-time record number of new licences in 2023.

Emerging economies such as Brazil have also significantly ramped up their exploration activities. Petrobras has acquired the biggest share of over 200 billion barrels of oil equivalent licensed in Brazil over the last 12 months. This represents about 90 MtCO2 of additional carbon emissions that risk being released into the atmosphere. Brazil is also expected to continue licensing new fields and has decided to keep bidding rounds open indefinitely.

In the United Kingdom, on the other hand, a newly elected government has pledged not to issue any new exploration licences. This development, among others, led Rystad to lower its forecasted estimates for 2024.

About the Carbon Minefields Newsletter

This newsletter is produced using data from Rystad Energy (2024) extracted from the UCubeExploration Browser v. 2024-07-02 and published with Rystad’s permission. Embodied emission estimates were calculated by the authors using the Intergovernmental Panel on Climate Change emission factors of crude oil, condensate, natural gas liquids, and gas. Data manipulation is automated with Python programming. Most text is generated with OpenAI's application programming interface using GPT-3.5 Turbo. The AI-generated outputs for this edition were produced on July, 15, 2024. International Institute for Sustainable Development experts review all AI-generated content for accuracy, clarity, and further interpretation.

*This section was amended after publication to clarify how the capital expenditure data was collected.

For more information regarding the data presented and for national-level disaggregation, please contact us at oboisvonkursk@iisd.ca or ceposadap@iisd.ca.

Participating experts

You might also be interested in

No New Fossil Fuel Projects: The norm we need

A new article in Science calls for an end to new fossil fuel projects, showing they are not needed in the energy transition to net-zero emissions.

No New Fossil Fuel Projects: The logical first step in a transition to clean energy

Our experts propose a viable pathway to phase out fossil fuels, even when they are so embedded in people’s everyday lives, in the global economy, and in powerful political interests.

NDCs, long-term strategies should include roadmap for fossil fuel producers: IISD

Analysis by policy think tank IISD shows that seven of the 20 largest fossil fuel producing countries make no mention of fossil fuel production in their Nationally Determined Contributions (NDCs) and six others stated an intention to continue or increase production.

The Production Gap

The annual Production Gap Report highlights the concerning gap between Paris goals and countries' plans for fossil fuel production.